A strong local search presence is key for wealth managers as clients turn to digital channels to find and evaluate financial advisors. Wealth managers can capitalise on this ensuring they are visible, credible, and easily found in search engines. We explain useful strategies to optimise local search results by integrating targeted marketing tactics and highlighting the role of Google reviews.

Understanding the local search landscape

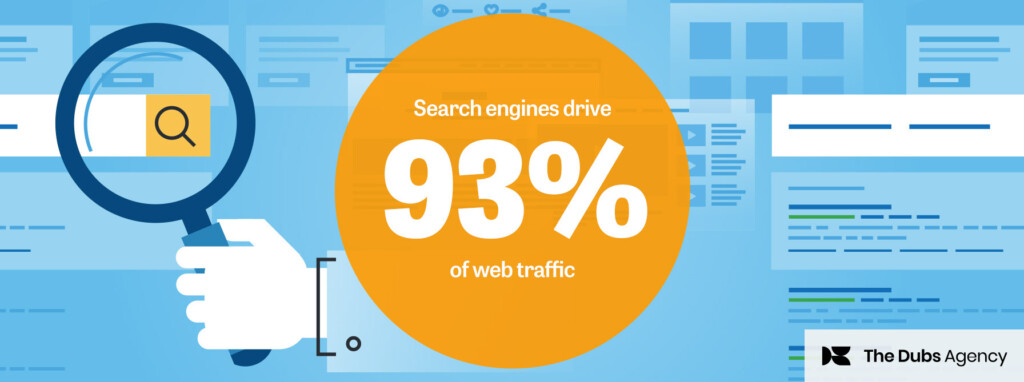

Local search optimisation involves enhancing your visibility in search engine results for geographically related queries. This is crucial for wealth management firms as potential clients often seek personalised, face-to-face financial guidance within their locality. The aim is to ensure you appear prominently when someone searches for “wealth management firms near me” or “financial advisors in [city]”.

Speaking to Andrew Frith, Media Strategist at finance marketing specialists The Dubs Agency, he shares, “As a wealth management business, understanding and leveraging local SEO is crucial for enhancing an online presence and connecting with potential clients in the local community.”

“By implementing targeted strategies and focusing on local search optimisation, we can ensure that the business stands out in search results, driving both traffic and trust.” Frith said.

Best practice for local search

At the top of the marketing funnel, the awareness stage, your potential clients are beginning their search for financial advice and wealth management services. Therefore, it’s critical to establish a solid foundation with comprehensive on-page SEO:

- Keyword research and optimisation: Identify and include relevant local keywords in your website content. Tools like Google’s Keyword Planner can help pinpoint terms such as “wealth management [city]” or “financial advisors [city].”

- Google My Business (GMB) profile: Claim and optimise your GMB listing. Ensure all information—address, phone number, website, and hours of operation—is accurate and consistent. Regularly update your GMB profile with posts about events, blog articles, or market insights.

- Local citations: Ensure your firm’s name, address, and phone number (NAP) are consistently listed across all local directories and citation sites. Discrepancies can undermine search engine trust in your business location.

As prospects move to the consideration stage, they evaluate different firms based on credibility and the depth of engagement. Content and reviews play a critical role at this point:

- Content marketing: Publish high-quality, locally relevant content on your blog or resource centre. Topics could include regional economic forecasts, investment opportunities, or case studies of successful client strategies within your locality. Local information accounts for 46% of all Google searches.

- Google reviews: Encourage satisfied clients to leave positive reviews on your GMB profile. Reviews significantly influence local search rankings and client trust. Respond to all reviews—positive and negative—to demonstrate your firm’s commitment to client satisfaction and engagement. According to SEO platform BrightLocal, its Local Consumer Review found 91% of consumers say local branch reviews affect their views on brands.

- Local backlinks: Build backlinks from reputable local websites. Collaborate with local business groups or contribute articles to local news outlets. High-quality backlinks signal to search engines that your business is an authoritative source in your area.

“ As a wealth management business, understanding and leveraging local SEO is crucial for enhancing an online presence and connecting with potential clients in the local community.”

In the decision stage, potential clients are ready to choose a wealth management firm. Here, the focus shifts to turning leads into clients through optimised conversion paths and trust-building measures:

- Conversion rate optimisation (CRO): Ensure your website is optimised for conversions. Include clear calls-to-action (CTAs). Use localised landing pages to cater to specific geographic segments, improving relevancy and engagement.

- Client testimonials and case studies: Showcase detailed testimonials and case studies from local clients. These serve as powerful social proof, reassuring prospects of your firm’s effectiveness and reliability.

- Localised ad campaigns: Run targeted local ad campaigns using Google Ads and social media platforms. Geotargeting allows you to reach users in specific locations, enhancing the relevancy and impact of your advertising efforts.

The role of analytics and continuous improvement

As optimisation is an ongoing process, use analytics tools such as Google Analytics and Google Search Console to monitor your local search performance. Track metrics like organic traffic, click-through rates (CTRs), and conversion rates. Analyse which keywords and content pieces are driving traffic and adjust your strategies accordingly.

Optimising local search presence for wealth management firms is a sophisticated, multi-faceted endeavour that integrates various elements of digital marketing. By focusing on each stage of the marketing funnel—awareness, consideration, and decision—you can enhance your firm’s visibility, credibility, and conversion rates.