COVID-19 has affected the shopping habits of consumers globally. More than ever, finance brands need to accommodate a hybrid shopping experience that balances in-person shopping with online experiences. For banks, a hybrid shopping experience can be used in physical stores, with technology improving consumers’ customer experience. For finance brands like insurance companies, for example, a hybrid shopping experience is about embedding yourselves within an existing shopping experience.

Creating a frictionless in-person experience that transfers seamlessly into the digital space can be difficult and requires new and emerging technologies to be incorporated into your finance brands’ technology infrastructure. Adobe and Stripe are some technology brands helping finance brands build integrated systems that better enable them to accommodate all customer experiences. Another way of facilitating a hybrid shopping experience, is for finance brands to build partnerships with retailers to enable them to integrate their digital products within the in-person shopping experience. A hybrid shopping experience balances the best of both worlds by providing the hyper-personalised and accessibility of the digital space within the real world. So, how can your finance brand create a hybrid shopping experience and why should you?

The hybrid shopping experience

Younger generations, like Gen Z and Millennials, are digital natives and highly value online experience for its personalisation and ease of use. Yet, many of them, alongside older generations, still value the in-person shopping experience. Creating a hybrid shopping experience, that incorporates digital technologies within the physical space, is the way of the future. In fact, 74% of consumers now expect a hybrid shopping experience.

Tesco and Amazon have already implemented this style of customer experience, implementing a “just walk out” technology where they’ve removed the need for checkouts – and consumers are loving it, with many of them enjoying the efficiency and ease of use. This technology

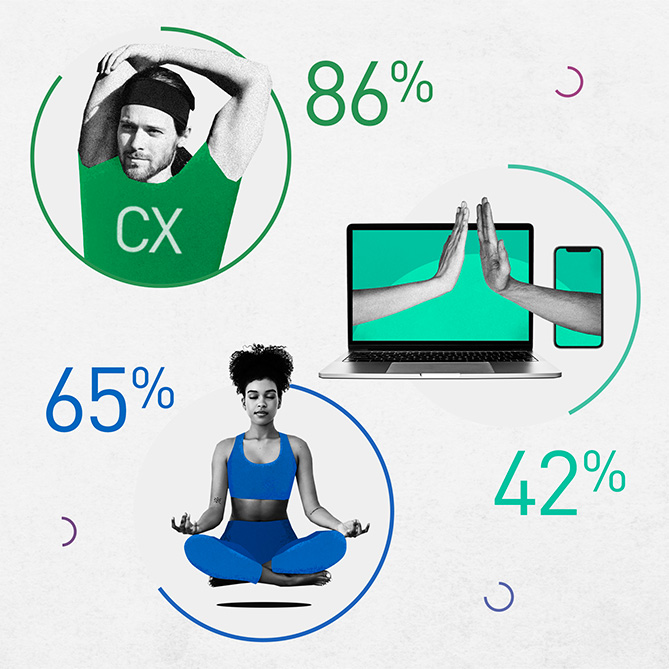

Addressing consumers’ digital and social needs is an important factor in the overall customer experience. Consumers are demanding more personalised customer experiences and hybrid shopping enables this. Research by McKinsey noted personalisation yields a 20% higher customer satisfaction rate and a 10-15% boost in sales conversion rates.

“ 74% of consumers now expect a hybrid shopping experience.”

But what can your brand do to create a hybrid shopping experience?

Two technologies helping finance brands create a hybrid shopping experience

Stripe is one fintech highlighting how they have created and integrated a hybrid shopping experience within the retail space. While usually they exclusively provide online payment systems, they have recently introduced their online payment structure into the physical world.

By building a point-of-sale terminal product Stripe bridges the gap between online and offline payments, providing merchants with an omnichannel platform that helps make it easier to manage eCommerce transactions with in-person transactions. This product helps to streamline merchants’ workflows and provide a greater customer experience by improving the customer service. By creating an integrated offline and online payment system for merchants, consumers’ information is more accessible meaning purchase history, warranty, and receipts can be stored, making customer claims easier to process.

Tesla is another example of how finance brands can integrate themselves within the physical shopping experience through retail partnerships. As a customer purchases a Tesla, they are also encouraged to purchase insurance digitally during the process to ensure consumers’ car insurance is completed even before they leave the store. Partnering with Aviva and Liberty Mutual Insurance Company in America and Canada, these finance brands have made the customer experience even easier by providing their digital services during in-person shopping experiences.

Technology brand Adobe has created an innovative technology that enables banks and finance brands with physical stores to build a hybrid shopping experience.

Adobe’s creation of Sensei has revolutionised the physical store experience. Sensei is a digital technology that enables banks to adapt their digital content and online experience into physical stores. Adobe Sensei can do a number of things including:

- Automatically reformat content on a finance brands’ website or app to fit a screen inside the branch helping to consolidate marketing campaigns.

- Finance brands with physical stores can capture and analyse location data. This means when a consumer enters the store staff are alerted, if the consumer walks up to a screen personalised suggestions are available and finance brands can analyse consumers’ time within the store.

- Finance brands can understand and accumulate data on what consumers are doing both in-store and online, which hasn’t previously been possible.

Learning lessons for finance brands

The customer experience is critical to retaining consumers and acquiring new ones. In fact, consumers who have a great customer experience are 5x more likely to recommend a brand and 54% more likely to make another purchase. As technologies continue to improve, consumer demand for more advanced, personalised, and seamless customer experiences will increase.

Hybrid shopping is the way of the future.