Research by RedPoint Global has highlighted that consumers and finance brands are mismatched in their priorities when it comes to CX design. In fact, 82% of consumers say most brands have significant room for improvement in delivering a consistently exceptional CX. While 51% of marketers believe they are delivering excellent CX design in 2021, only 26% of consumers agree. So, how can your finance brand deliver a CX design that reflects what consumers are demanding?

CX design can make or break your finance brand

A 2020 Walker study found that customer experience overtakes price and product as the key brand differentiator. CX design plays an important role in acquiring and retaining consumers. CX is the new battlefield with over two-thirds of brands now competing primarily on the basis of customer experience alone.

When it comes to delivering great CX design, understanding what consumers want is critical. Yet, more often than not, finance brands are getting it wrong. Redpoint Global did an extensive survey to find the three key areas finance brands aren’t delivering great CX for consumers: They are:

- Understanding the consumer (77%)

- Personalisation (77%)

- Omnichannel marketing (72%)

Understanding the consumer

Like with any aspect of financial marketing, it’s critical you understand your target audience well. Gaining superior data quality is a key area of opportunity for your finance brand.

While it’s easy to feel like you’re drowning in data, you need to set parameters for the type of data you’ll analyse. Your checklist may look like:

“ 82% of consumers say most brands have significant room for improvement in delivering a consistently exceptional CX.”

- Target market (age, gender, income, location, etc.)

- Marketing and social media analytics (click-throughs, impressions, conversions, etc.)

- Customer data (persona, spending patterns, offers they’ve declined, online activity, social network activity, service preferences)

- Prospect data

- Qualitative data

- Competitors

By understanding your consumer’s data you can find customer pain points and areas for improvement, leading to the creation of a great CX design.

Personalisation

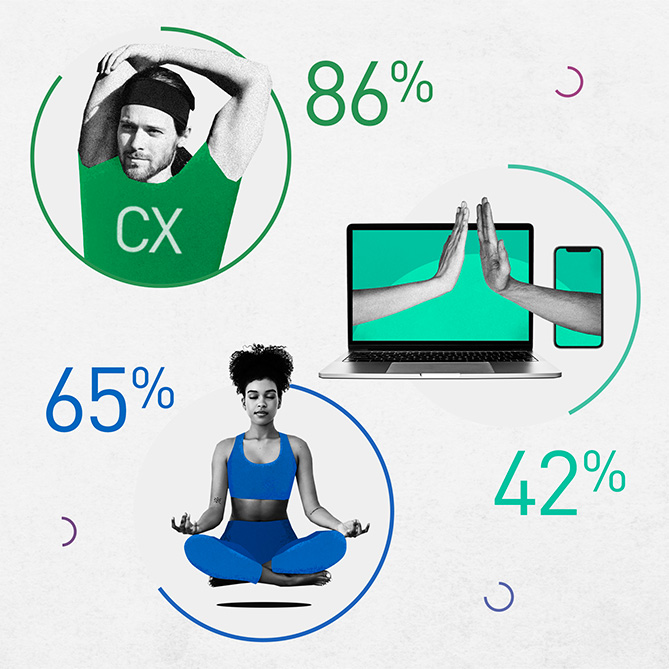

Personalisation is becoming increasingly more important as consumers continue to increase their dependence on digital finance management tools. In fact, 72% of consumers say they only engage with personalised messaging. But where should you focus your personalisation strategies?

According to research by McKinsey, here are the five top areas your finance brand should focus on:

- 75% of consumers want personalisation to make it easier to navigate in-store and online purchasing

- 67% of consumers want relevant and tailored product/service recommendations

- 66% of consumers want messaging tailored to their needs

- 65% of consumers want targeted promotions

- 61% of consumers want brands to celebrate their key milestones

Omnichannel marketing and CX design

Consumers are wanting more consistent, omnichannel marketing from finance brands. With brands that implement omnichannel marketing experiencing 23x higher customer satisfaction rates, it’s a key area your finance brand should improve.

Omnichannel marketing in the context of CX design means no matter where your consumers interact with your finance brand they always have a great customer experience. Rather than focusing your CX design on one area, like your website, taking a holistic perspective and identifying areas of improvement across your entire marketing strategy can give you a competitive edge.

The Redpoint Global report asserts, “with consistency being consumers’ most important dimension and also among the top area they feel brands are falling short, focusing on overcoming the challenges this dimension presents to marketers should be a top priority.”

It’s time to improve your CX design

At the end of the day, CX design is now one of the most important aspects of acquiring and retaining consumers. While your finance brand may believe it’s delivering great CX, it probably isn’t aligning with your consumer’s expectations. It’s time to reconsider your CX and align it with what your target audience is demanding.