As we move into a future increasingly dominated by technology several key trends are emerging that will reshape how your wealth management firm approaches search marketing. These trends, including voice search, AI-powered chatbots, and the integration of search with other digital channels, are not just buzzwords—they are fundamental shifts redefining how to engage with clients and prospects.

AI recommendation Optimisation (AIRO)

A significant shift in search marketing is the move from traditional SEO to AI recommendation optimisation (AIRO). It’s no longer just about getting onto Google’s first page; it’s about ensuring AI engines include your firm as a reference in their answers to queries.

AIRO involves optimising content so it aligns with the algorithms of AI-powered recommendation systems. This means creating high-quality, authoritative content that AI engines deem valuable. For wealth management firms, this could involve producing in-depth analyses, whitepapers, and expert commentary on financial trends and strategies.

Additionally, leveraging structured data and schema markup can help AI engines better understand and index your content. This can improve the chances of your firm being recommended in AI-driven search results.

Voice search: The new frontier in search marketing

Voice search is becoming a significant player in the search marketing arena. As devices like Amazon Echo, Google Home, and Apple’s Siri become ubiquitous, the way people search for information is changing. For wealth management firms this means optimising content for voice search is important.

Voice search queries tend to be longer and more conversational than text searches. Therefore, structure content t answers specific, nuanced questions. For example, instead of focusing on keywords like “investment strategies,” wealth management firms can target natural language phrases such as “What are the best investment strategies for retirement?”

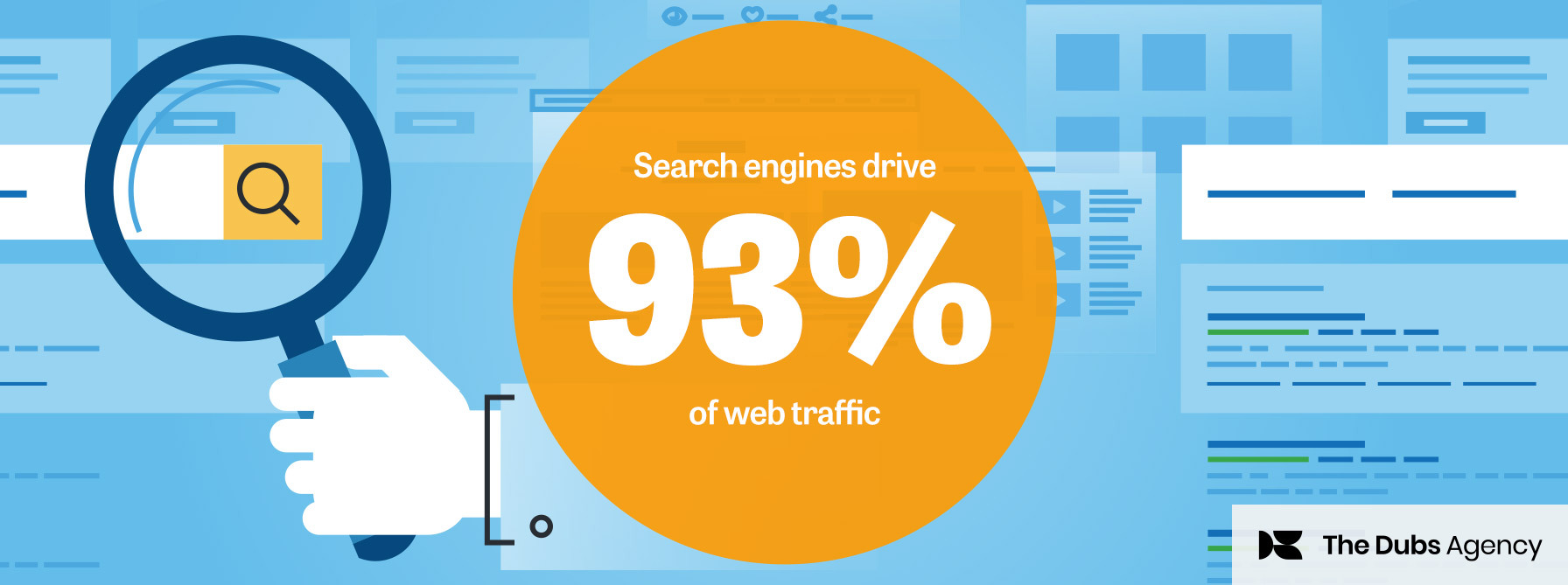

“ Search engines drive 93% of web traffic.”

The rise of voice search also highlights the importance of local SEO. Many voice searches are location-specific, such as “financial advisor near me.” Ensuring your firm’s local listings are accurate and optimised can significantly enhance visibility in voice search results.

AI-powered chatbots: Revolutionising client interaction

AI-powered chatbots are another transformative trend in search marketing. These chatbots leverage artificial intelligence to provide real-time, personalised responses to client queries. For wealth management firms, AI chatbots can serve multiple purposes, from answering basic inquiries to providing complex financial advice.

The key to a successful chatbot is the integration of advanced natural language processing (NLP) capabilities. This allows the chatbot to understand and respond to nuanced financial questions effectively. Furthermore, chatbots can gather valuable data on client preferences and behaviours, which can be used to refine marketing strategies and improve service delivery.

For instance, if a chatbot frequently receives questions about retirement planning, this insight can inform content creation and SEO strategies, ensuring your firm’s website ranks highly for related search terms.

Integrate search with other digital channels

Search marketing is no longer a standalone effort. Integrating search with other digital channels, such as social media, email marketing, and content marketing, makes for a cohesive strategy. This holistic approach ensures all channels work together to enhance visibility and engagement.

For wealth management firms, this means creating a unified message across all platforms. For example, search-optimised blog posts can be promoted on social media and included in email newsletters. This drives web traffic and reinforces your firm’s expertise and thought leadership.

The further integration of search with digital advertising, particularly with platforms like Google Ads and LinkedIn, allows for highly targeted campaigns. These platforms provide sophisticated targeting options based on demographics, interests, and behaviours, helping firms reach high-net-worth individuals more effectively.

Staying ahead of the curve in search marketing

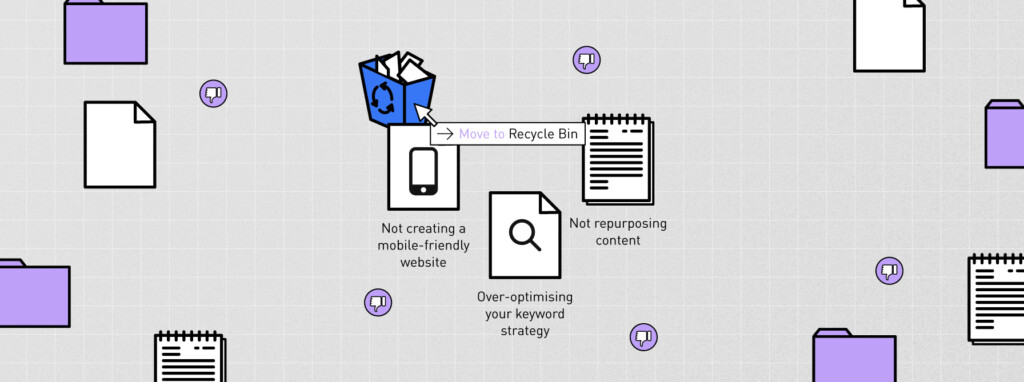

To stay ahead in this evolving landscape, wealth management firms can use a proactive approach to search marketing. This involves continuous learning and adopting emerging trends and technologies. Here are a few steps you can take:

Invest in advanced SEO and content strategies: Focus on long-tail keywords and natural language phrases that align with voice search queries. Produce high-quality, authoritative content that AI engines value.

Implement and optimise AI chatbots: Ensure your chatbots have advanced NLP capabilities and can provide personalised, real-time responses to client queries.

Integrate digital channels: Create a unified marketing strategy leveraging search, social media, email, and digital advertising to maximise visibility and engagement.

Adopt AIRO techniques: Optimise content for AI engines by using structured data and schema markup. Focus on creating content AI systems recognise as authoritative and valuable.

By embracing these trends, you can not only enhance your search marketing efforts but also deliver a superior client experience in an increasingly digital world.