In September St George published the results of a survey about home loans revealing 18% of people would rather sit in peak hour traffic than go through a traditional home loan application process. Adding insult to injury, 20% would rather go to the dentist and 19% would prefer to dine with the in-laws. If your finance brand is being let down by your onboarding process, it’s time to prescribe some pain relief for your customers, get a jump on the competition, and start fashioning your home loan of the future.

It makes for amusing reading, but the upshot is home loans still frustrate the heck out of customers, especially first home buyers. St George respondents cited three top irritants: the amount of red tape or paperwork, not knowing where you stand, and the process taking too long.

18% of people would rather sit in peak hour traffic than go through a traditional home loan application process, 20% would rather go to the dentist and 19% would prefer to dine with the in-laws.

We really didn’t need a survey to tell us that. Look at the amount of verification required – documents to provide and questions to answer, living expenses pored over – the endless back and forth. It feels invasive and repetitive, with manual intervention at every step of the way. And the process takes so long.

Already banks are required by APRA and ASIC to keep records explaining why an application has been assessed in a certain way. After the banking Royal Commission publishes its final report, we might find scrutiny of loans ratchet up a notch or three.

How St George tackled their painful process

St George says it tackled the home loan pain problem by launching a new online home loan application tool “to simplify the process and help educate buyers along the way”. Their app gives St George applicants a personalised home loan snapshot, showing how much they can borrow, upfront costs and monthly repayments. There’s also a “personalised” interest rate. Basically, it’s an indicative approval pre-auction in under 15 minutes and doesn’t require you to go through the full face-to-face process. And it’s written in a plain-English, non-taxing way.

It’s a step in the right direction. After you apply though, you still have to talk through the whole thing with a home loan expert. St George still needs to assess the suitability of the loan for your purposes, verify your information and check your credit history before they can proceed to conditional approval.

Compare that to how some fintechs are doing it. We’ve already blogged about Tic:Toc, the online-only lender that uses a digital algorithm to process your application in real time. Their pitch is the “22-minute home loan,” (assuming you have all your documents ready).

The future for home loan onboarding

So back to St George and the major banks. The last thing you want, if you’ve invested in finely-tuned content marketing, is a cumbersome home loan process that turns away the customers you’ve fought so hard to win over.

Digital is awesome, everyone says so. But just dumping everything online isn’t enough. Here are some thoughts about what mortgages might look like in the future to help raise your aim.

- We’re the last generation who will use the term mortgage. This from retail banking innovator and banking futurist Brett King.

- It’s not just a matter of retrofitting the old-school mortgage application into an online form. You’re dealing with homebuyers who are digital natives. The process must be intuitive and interactive.

- Digital natives look for customised, personalised experience (think curated playlists) and transparency around fees and costs.

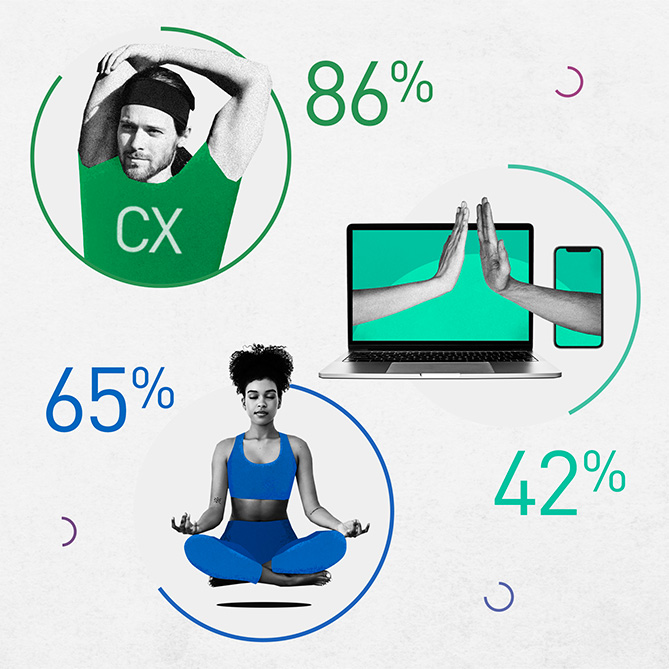

- Borrowers will want to be able to check the status of their loan at any time and from any device.

- Digital processing and data leveraging will reduce the turnaround time of loans to hours not weeks and reduce the amount of information an applicant needs to submit.

- The real shift for banks is around experience. Think voice commands, phone apps, augmented reality as part of home loan platforms – more accessible and with fewer touch points. There will likely come a day when there are no touchpoints.

- The future will be all about responding to a customer when and where they need help, and not just during business hours. Think 24/7 access to service, with or without human intervention, and on any medium.

- Processes will be frictionless, products will not be reinforced through multi-channel architecture and nobody will “own” customers.

- Even the smartest digital processes need a human touch at times. Combining an automated mortgage process that takes minutes, with a friendly voice to help answer any questions might be the best balance of old and new.