Generally defined as households with investable assets of US$100,000 to US$1 million, mass affluents represent a huge opportunity. The US mass affluent wealth band alone is expected to account for upwards of $US47 trillion of wealth by 2025. In Asia, the mass affluent wealth pool is projected to reach US$4.7 trillion by 2026.

Who is this diverse segment?

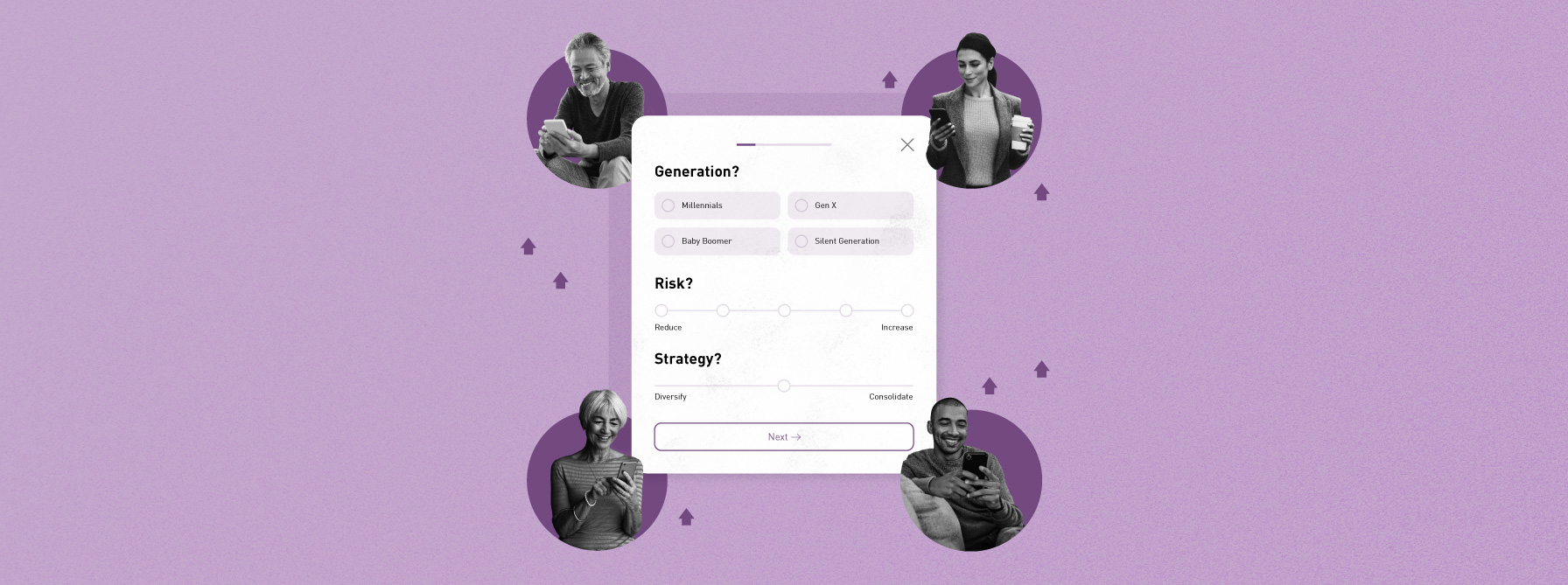

There is no one generation, demographic or attitude that describes all mass affluent investors. This group is present in most generations, from Millennials and Gen X to the Silent Generation. Their goals, experiences and behaviours vary significantly. They are ethnically diverse and their wealth comes from a range of sources. Some are accumulating wealth, some aren’t; and accordingly, their retirement horizons can be quite different.

Studies have shown that this segment is increasingly open to paying for wealth management, though in the past many have been inclined to use digital investing platforms, and many will continue to do so. They are often price conscious and will compare providers’ fees.

The younger mass affluents expect fast access to information through a variety of delivery channels. There is always a risk they will switch if their needs aren’t being met.

How do asset and wealth managers secure their share of this market and help drive profitability at a time when margins are constantly being squeezed?

The P word

Mass affluents are used to personalisation in their shopping experiences and in the delivery of day-to-day digital services. They’ve been spoiled by providers who know what they might need at any particular time.

As investors, mass affluents might not feel the need to visit with an adviser in person, but many still want that personal touch. They expect a tailored approach to products, advice, and in the content and analysis they receive. This puts the onus on the wealth professional to get savvy to customers’ personal financial circumstances, risk tolerance and needs.

Adding value to the relationship is essential. That might be through regular performance reviews of portfolios, highlighting risks and opportunities and re-allocating as required. And through more nuanced content types and distribution.

Content for the mass affluent

Offering a bland menu of one-size-fits-all insights and analysis through a rigid set of channels won’t cut it with this segment.

While evergreen content of broad appeal will always have a place, managers also need to create relevant, personalised content aimed at subsets of this audience. Which goes well beyond putting the client’s first name in the email – it’s ultimately about knowing what they need at that time. These smaller sub-audiences will use different products for different purposes at different times and content must be aligned to that, harnessing tags and behaviour-based tracking.

What stage are they at in their wealth journey – still in accumulation or closer to retirement? Are they looking to increase or reduce risk? Diversify or consolidate? Data, of course, is the key to establishing these subsets and their needs, but it must be gathered without impacting privacy or security.

Surveys can help you find out who’s feeling underserved with information, and what types of content they prefer. If you can link data from different campaigns to get a unified view of the customer, even better.

With audiences identified, content can be targeted, whether social posts, blogs, infographics or longer-form advice formats, and then distributed to relevant audiences across channels. Email is a simple way to ensure the right people get the right content.

Personalisation has been heralded as the new way to wow audiences, and with good reason – it can reduce friction in the client journey, engage clients better, deepen relationships and loyalty. Don’t forget though, that personalisation needs to be mapped within a well-considered content strategy.