As of October 2018, ASIC has been conducting a review of school banking “to understand the motivations and behaviours around school banking programs” for young Australians.

CommBank says it welcomes ASIC’s review of its program Dollarmites, which is voluntary for schools and parents and which gives students fee-free savings accounts until they’re 18.

Commbank’s Dollarmites is designed to encourage regular savings behaviour and good money habits and is the largest program of its kind, reaching about 14% of the 5- to 12-year-old population. A financial analysis by Pennybox app founder Reji Eapen suggests that Dollarmites and the high-school-age targeted Start Smart program have a long-term value of $10 billion for CommBank. There’s no denying it’s a mutually beneficial arrangement, tied to an investment from CommBank to help tackle low levels of financial literacy levels across Australia.

The impact of school banking

Nearly two-thirds of the nation’s schools participate in school banking which includes programs from Bendigo Bank, IMB, BCU, Northern Inland Credit Union and The Mutual Bank@School, amongst others.

Benefits for schools include cash incentives for sign-ups and bonuses for P&C organisations.

Many of the programs’ online components are gamified with colourful activities, animated characters designed to illustrate basic money concepts, and lesson plans for teachers.

Bendigo Bank invites kids into branches to see how money’s collected and to learn about money and banking. Hume Bank provides teachers with workshop tools for both primary and high school. Commbank’s program includes workshops for primary school students on money, saving, banking, and spending.

Is it so wrong?

In 2015, a spokesperson from the Customer Owned Banking Association pointed out that financial institutions are filling a gap in providing financial literacy programs targeted at young people.

Financial institutions are filling a gap in providing financial literacy programs targeted at young people.

Yet the Australian Education Union and others say financial literacy should be the province of teachers, who are familiar with students’ backgrounds and interests and are there at the “point of need”.

But does it need to be one or the other? Armed with the resources offered through school banking programs, teachers can use this familiarity to support students struggling with complex financial concepts by personalising messaging and materials.

Given the low levels of financial literacy in Australia, with the Deloitte Access Economics’ 2018 Financial Consciousness Index showing nearly one-third of the population is “financially vulnerable”, we need to look to increase rather than reduce opportunities for people of all ages to learn how to better manage their finances.

A review of existing programs to ensure they are meeting young people’s needs is a positive initiative that should lead to improved programs where the focus is on educating kids to ensure they have the knowledge and empowerment to make their own financial decisions.

The question we should be asking is ‘hands up who wants to help?’.

Related articles

- Spriggy: breaking the cycle of financial illiteracy in Australia

- Financial literacy: consumers look to banks for help

- Kinder content is key to financial literacy

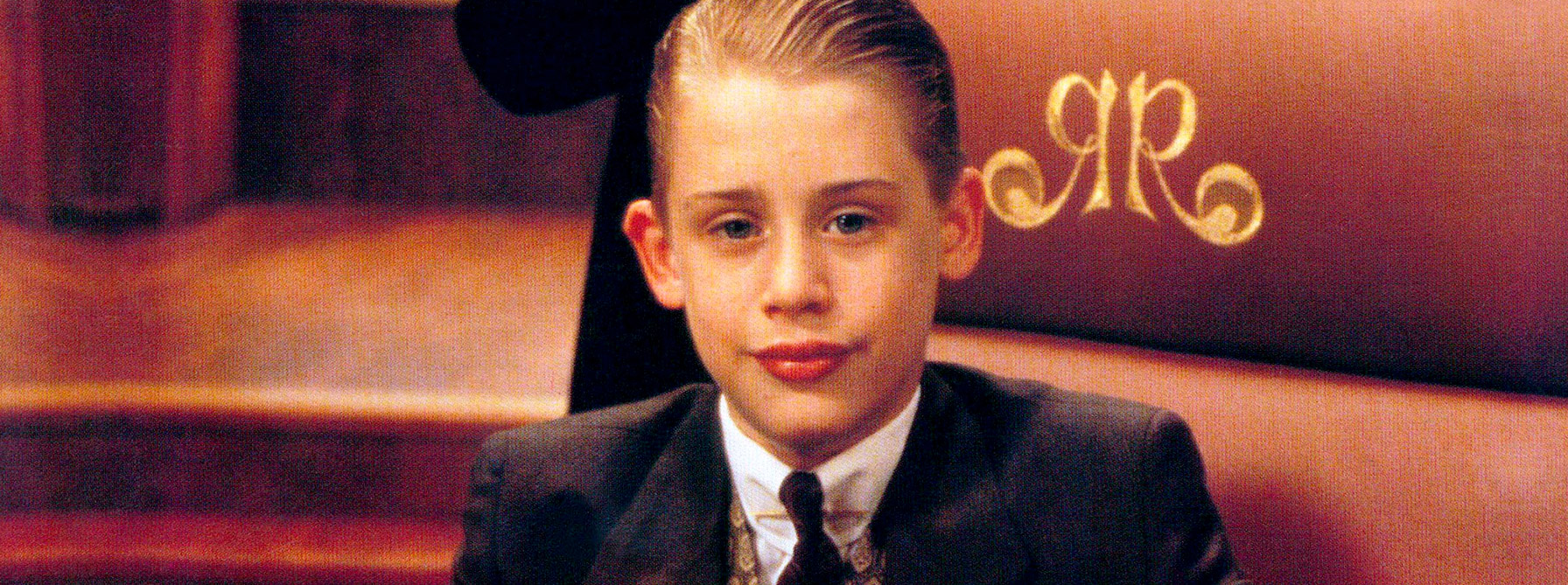

Image: Warner Bros