The UK is in the midst of a banking revolution.

In the wake of the 2008 financial crisis, the industry faced an uphill struggle to win back its reputation and its customers. Throw in the addition of the Bank of England’s simplified licence criteria in 2013, including lower capital requirements, and the door was opened wide for the challenger banks. The fruit of this shift started to show last year with a number of digital-only banks receiving their licences and launching betas. As the dust settles though, which brands are showing signs of success?

Atom Bank leads the charge

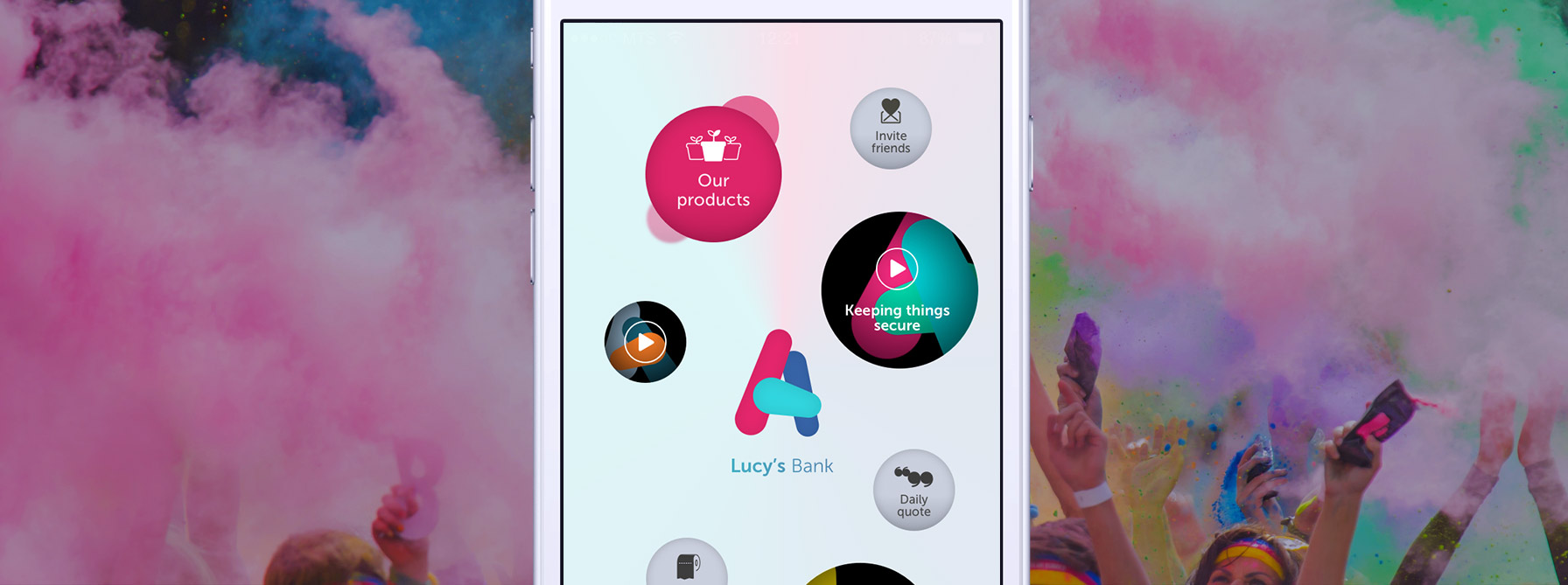

Atom Bank is out in front, for now, after receiving its banking licence in June 2015 and launching in April 2016. Earlier this year thousands registered their interest in the bank when it announced a limited, inflation-beating, one-year fixed savings account rate of 2%, some 0.4% higher than its nearest competitor.

The bank also raised a further £83 million in funding in March from existing investors, led by Spanish bank BBVA. This additional funding means Atom has a post-money valuation of £261 million. Now the start-up is even dabbling in celeb-power, with Black Eye Peas singer Will.i.am being named as a strategic board advisor last month.

Atom’s product range started with two fixed saved accounts but has since grown to include a mortgage offering and will soon be adding current accounts, debit cards, overdrafts and instant access savings accounts.

Who else is in the race?

…the game has changed. Customers are more tech savvy, less put off by the thought of changing banks and increasingly digital first.

2017 could see up to 17 new challenger banks enter the market alongside Atom, offering current and savings accounts alongside deposit and loan offerings, including much-lauded Monzo and Starling. The latter has just launched a beta of the app that powers its current account and also announced a partnership with currency exchange service TransferWise. Unlike Atom, which uses existing banking software as a foundation for its app, Monzo has chosen a classic digital startup route , building most of its platform from scratch using open-source software. It plans to start rolling out full current accounts to its beta customers over the coming months.

Tandem bank looked set to be another big player but lost its banking licence in March after its Chinese-owned main investor House of Fraser pulled most of its capital out due to government restrictions in China. The list goes on: Tide will focus on SEMs, Soldo plans to target families, budgeting and cash flow while Loot aims to seduce students with a prepaid Mastercard and money management app.

Traditional banks feeling the pressure

For years, a small group of large banks has been dominant in the UK with little to no competition, but the game has changed. Customers are more tech savvy, less put off by the thought of changing banks and increasingly digital first.

Challenger banks are certainly a real threat to the Big 5 banks in the UK, with numbers growing and niches being carved out. If they prove their success, this could well be a trend that spreads globally.

Subscribe now for content marketing insights and trends straight to your inbox.