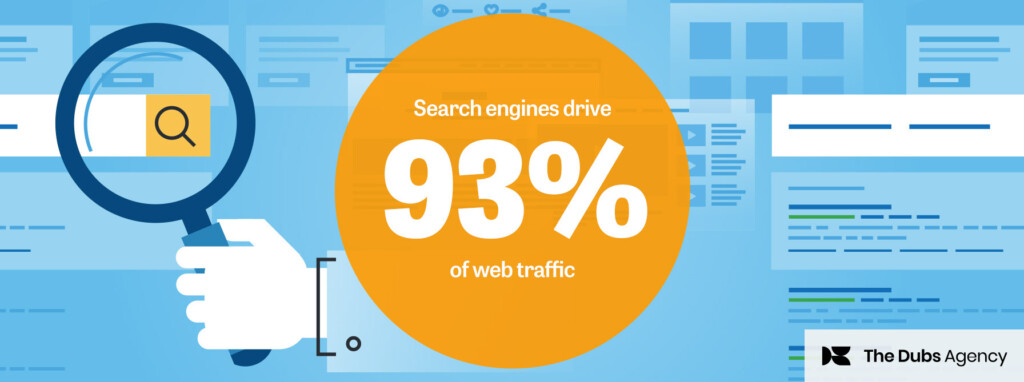

Search engine marketing (SEM) has been a cornerstone of digital media strategies for financial brands for more than a decade. But the landscape is shifting. Rising costs, shrinking organic reach, and the dominance of AI-generated answers are reshaping how consumers find and engage with financial services online.

Forward-looking marketers are asking: if SEM is no longer enough, what comes next?

The SEM squeeze

The cost of search ads continues to climb. Wordstream reports that the average cost-per-click for financial services is $3.44, one of the highest of any sector. Competition for key terms like “home loan” or “financial adviser” is intense, but even the top paid placements no longer guarantee meaningful traffic.

AI-powered search experiences are accelerating the shift. A Semrush study predicts that 75% of search traffic will be powered by generative AI by 2028. Zero-click results and summaries mean fewer people are clicking through to brand websites.

Smarter paid media: what’s working now

Financial marketers are diversifying budgets into channels that deliver stronger visibility, better targeting, and more measurable outcomes:

-

Contextual advertising: Instead of relying on third-party cookies, brands are aligning with trusted financial content where audiences are already engaged. ReportLinker notes contextual targeting is expected to grow 13.3% from 2020- 2027.

-

Native and sponsored content: Dianomi and other finance-specific networks report click-through rates up to 5x higher than display because ads blend with premium publisher environments.

-

Paid social with creator partnerships: Fidelity research shows nearly 50% of UK investors now look to social media for financial insights. Paid amplification of influencer content can extend reach beyond organic followings.

-

Programmatic guaranteed buys: For financial brands concerned about compliance, programmatic direct deals on premium inventory provide brand safety while still leveraging automation.

Lily Ray, Senior Director of SEO and Head of Organic Research at Amsive Digital says

“ AI Overviews change the game. It’s no longer just about ranking – you need to be understood by AI.”

Trends to watch

-

AI-driven media optimisation: Platforms are increasingly automating bidding and placement, but financial brands need to balance efficiency with governance and compliance.

-

Retail media networks: Banks and fintechs with owned ecosystems are beginning to explore retail media, offering advertisers access to highly segmented financial audiences.

-

Video-first campaigns: Paid video, especially short-form on LinkedIn, YouTube and TikTok, is outperforming static display in engagement for financial education and brand storytelling.

The bottom line

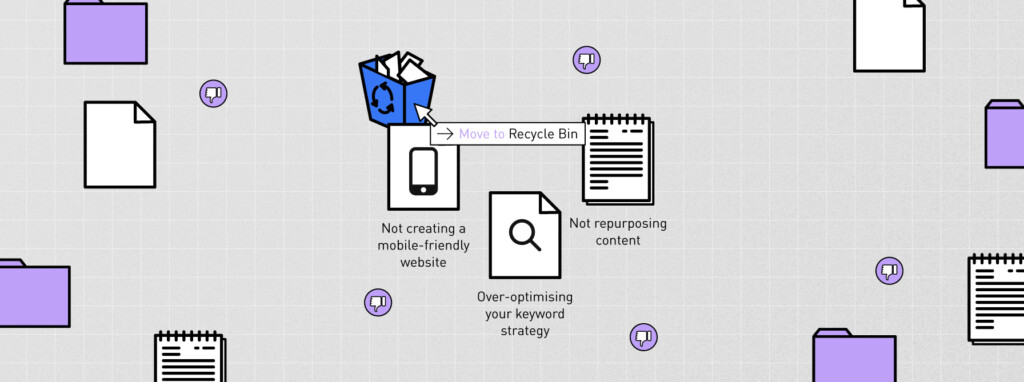

SEM is still part of the mix, but it can no longer carry the weight of a financial brand’s paid media strategy. Success now requires a broader, smarter approach that blends context, credibility, and creativity across channels.

For financial marketers, the next chapter in paid media isn’t about chasing clicks. It’s about being discoverable in the right places, with the right message, at the right moment.

If you liked this article and want to know more contact The Dubs Agency we’d love to help.

[For full disclosure: The author used Perplexity to research this article and the podcast was created using ElevenLabs]

Subscribe to our newsletter

News and analysis for Financial Marketers