The pandemic has changed consumers’ habits around the world forever. According to research by McKinsey, customer loyalty in the ASEAN region has decreased. In fact, 68% of Thai consumers and 80% of Filipino consumers are wanting to try out new brands. This makes it critical for ASEAN financial marketers to not only retain current ones but also attain new ones. To generate leads and foster brand loyalty, it’s important financial marketers optimise their marketing strategy. Here we explain three areas ASEAN financial marketers can improve.

Changed financial habits

“ 71% of users plan to continue to use digital channels to the same extent or more after the pandemic. ”

This is a great area for growth and opportunity for financial marketers looking to retain clients and gain new ones. By optimising your digital financial marketing strategy, you can begin to create real and authentic connections with clients across the ASEAN region. But how can you do this?

The three biggest areas for growth, according to research by McKinsey, for ASEAN financial marketers include:

- Improve performance marketing

- Ensure the responsible management of first-party data

- Balance spending between all channels

How ASEAN financial marketers can improve performance marketing

Performance marketing focuses on continually optimising core objectives such as a click, sale, or lead along the customer-journey funnel.

As the research team at McKinsey explain, “Performance marketing plays a vital role in driving customer experience, especially at the lower-funnel interventions, such as digitizing interactions and offering a customer-service response team that responds within an hour.”

To get this right, it’s important ASEAN financial marketers don’t focus on vanity metrics but hone in on the ones that matter. Rather than focusing on traffic or the number of users viewing your content, focus on metrics such as click-through rates or referrals. These are what matter and will help convert clients.

Manage first-party data responsibly

While personalisation is more important than ever to attract new clients and retain old ones, it can’t come at the expense of the client’s privacy. Privacy is critical to trust between the client and the finance brand. While first-party data should be scaled to continue to improve the customer experience, it can’t be at the expense of client trust.

The best way of not losing trust is by being transparent with your data. ASEAN financial marketers will need to continue to be transparent about what clients’ data is being used for, so as to ensure that trust is maintained and upheld. Additionally, implementing greater staff training, improving methods of preventing data theft, and ensuring data use is an opt-in system are other ways of maintaining trust and safety.

Balance spending between all social channels

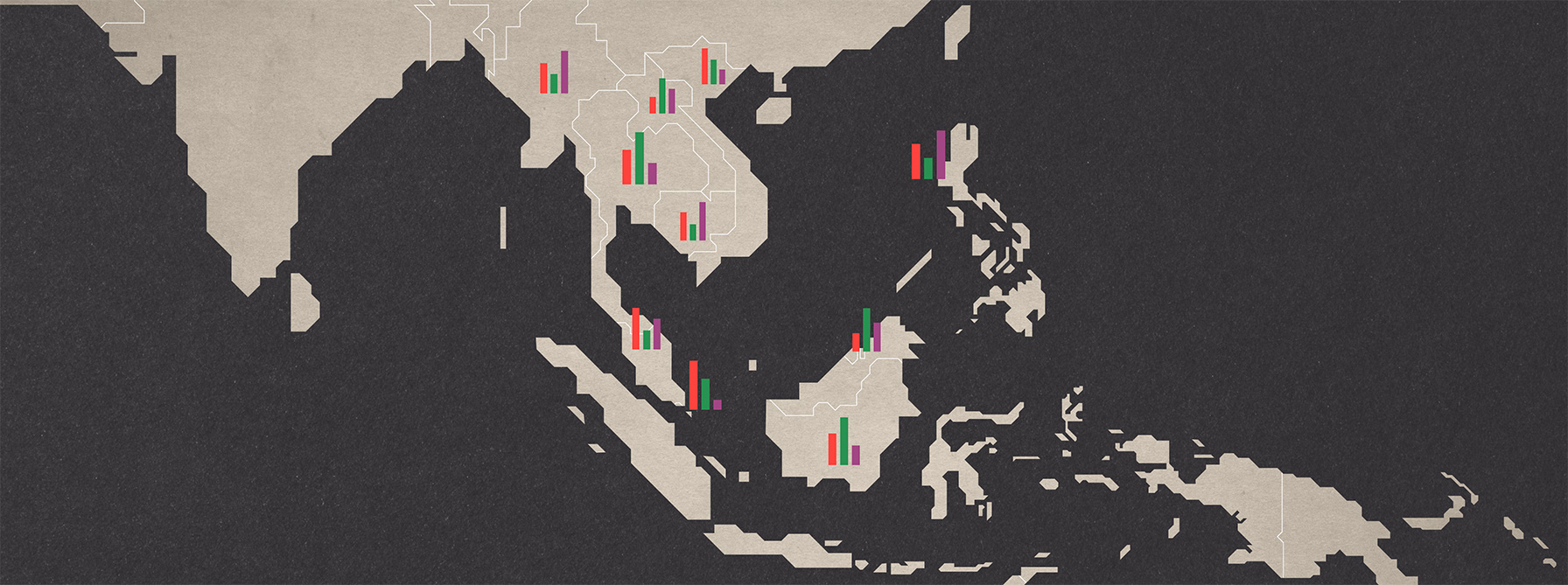

ASEAN financial marketers continue to find it difficult to understand how much money should be allocated to online and offline marketing strategies. To achieve the right balance, ASEAN financial marketers should be looking at the micro-market level, to see where spending makes the biggest impact.

Two ways ASEAN financial marketers can achieve this is by looking at:

- Geospatial analysis – this combines geographical data with other important information such as demographics, connectivity, behavioural and income data.

- Multitouch attribution – Rather than looking at the ‘last click’ that leads to the conversion, finance brands should consider the entire customer journey to understand the affect and ROI for each channel

Final thoughts for ASEAN financial marketers

As the world continues to move on post-pandemic, it’s important for ASEAN financial marketers to reconsider consumers’ habits and how this affects their marketing strategies. Focusing on areas for growth and re-optimising your finance brands’ financial marketing strategy can help you not only retain current clients but gain new ones.