As industry head, banking and payments at Google UK, Andrew Moody talks to a lot of financial service advertisers. And when he does, he always poses this question: are you keeping up?

Every year, hundreds of changes are made to Google’s search product. If you compare the current iteration of Google to what it looked like 19 years ago, you’ll see there’s been a fundamental transformation in both the search experience for users and the search product for advertisers. So, is your approach to search keeping pace?

Here are five changes Moody believes you should be making to get the best returns out of Google’s paid platform.

1. Attribution

In Moody’s mind, search gets unfairly pigeonholed as the thing that gets people over the line at the end of their path to purchase. “It’s unbelievable that so many financial services advertisers measure and optimise to last click, at the very bottom of the funnel,” he says. “If you’re not measuring properly and not assigning value correctly, you’re not getting the best use of this product.”

He believes that search plays a role at each stage in the funnel; and that financial service advertisers can be useful at every stage.

Using the example of a user who’s looking to take out a mortgage, “they’ll probably search a number of times over a few months. Why would you give all the credit to that last click before completing the mortgage application, when the decision as to what brand or product the user buys was probably made four or five searches ago?” he says.

Moody urges advertisers to make better use of the Google attribution tools available in AdWords and DoubleClick search.

One advertiser, price comparison site confused.com, used Google’s Attribution 360 product to increase paid search conversions by 28% – at a lower CPA. The product’s data-driven approach helps clients better understand the path to purchase, the role that different keywords play on the customer journey, and the associated value.

Confused.com had a suspicion that last-click attribution was distorting their view of keyword opportunities, and that lower funnel and branded keywords were probably getting too much credit.

“Attribution 360 insights confirmed they were over-investing in some keywords,” Moody says. “They re-allocated spend to drive up quote requests at a lower CPA – they were also able to better understand the role display can play alongside paid search.”

If you’re not measuring properly and not assigning value correctly, you’re not getting the best use of this product.

2. Making full use of audience

One of the biggest changes in how Google has evolved the product for marketers is through the use of audience data, allowing advertisers to engage with their customers and prospects based on previous interactions.

From what Moody has observed, he says financial services advertisers could be doing a lot more with products like Customer Match and Remarketing Lists for search ads.

3. Automation

There are a lot of variables at play in managing paid search activity: devices, ads, audiences, date and time. Moody says financial services advertisers should make use of Google’s automation tools to help manage bidding, targeting and creative.

“Our CEO, Sundar Pichai, talks about Google now being an ‘AI first’ company,” he says. “Our automation tools are an excellent way for banks and insurers to put machine learning to work to drive efficiency in their search marketing.”

4. Better use of creative

Creative goes hand-in-hand with attribution, Moody says. If financial brands better understand the role that search is playing at different stages of the path to purchase; they can then think about the most appropriate and useful messaging to move prospects along that journey.

“I would also love to see a better understanding of search within the wider marketing department and a reappraisal of the role it can play against different marketing objectives and through the customer journey” he says. “If you’re only thinking about it as that bottom-of-the-funnel role, you’re probably not going to be as creative as you may be with other channels or platforms that you see playing different roles.”

He talks of new formats and search extensions for advertisers, like being able to click a button on a mobile device and you’re through to the call centre; or an extension that can enable you to download the app from a bank or insurer. “An under-used extension is click to message – enabling customers or prospects to schedule a call-back by SMS”.

Moody fully understands that the regulatory environment financial services companies operate in and the role of internal compliance teams means that “banks are unable to get new creative signed off as quickly as other verticals”. But he challenges teams to review existing processes and ways of working and to find ways to be nimble and move at the pace of truly digital-first businesses.

5. Benchmarking

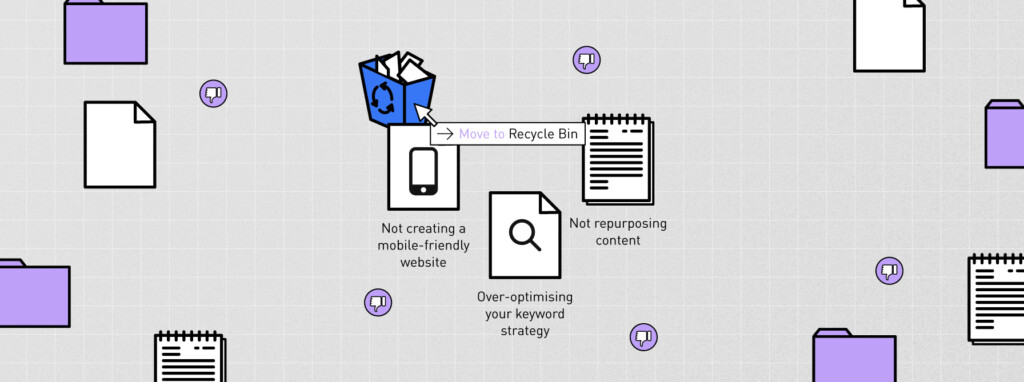

If you’re benchmarking against other advertisers in your category, you’re not trying hard enough according to Moody. You should be looking at the very best digital brands, not just for what they’re doing on search but right through to user experience. Think Amazon, Uber and Deliveroo, rather than just looking at best examples in your category.

Moody uses mobile UX to illustrate this. Over 50% of searches on products like car insurance, loans and mortgages in the UK come from mobile, he says. Mobile UX research done by Google in 2016 showed that 40% of people will abandon a site that takes more than 3 seconds to load, and 47% of people expect a page to load in less than 2 seconds.

Finance brands were found to have the least user-friendly sites in Europe with an average mobile page load time of over 4 seconds. “It’s all very well thinking about a great paid or organic search strategy, but you need to think about where you’re taking prospects or customers next – that’s all part of the user journey and experience.”

“It’s a mindset change,” he says. “Best-in-class advertisers and digital businesses move at pace; they get stuff done quickly, they test, they learn from their mistakes quickly, they put in place technical changes quickly – that can require cultural change and new ways of working.”

For more case studies and articles on search, see Think with Google. For product updates, visit The Keyword Blog.