With the rapid evolution of B2B buyer behaviour, one platform continues to stand out, LinkedIn and key stats reinforce its importance;

- Dreamdata reports, in 2024 LinkedIn Ads’ share of total B2B ad budgets grew from 31% in H1 to 39% by year-end.

- LinkedIn Ads drive the best ROAS of the main ad networks, with 113%, which also makes it the only network to generate a positive return.

- LinkedIn Ads influences 29% of MQLs, 36% of SQLs, and 35% of new biz deals – more than other platforms.

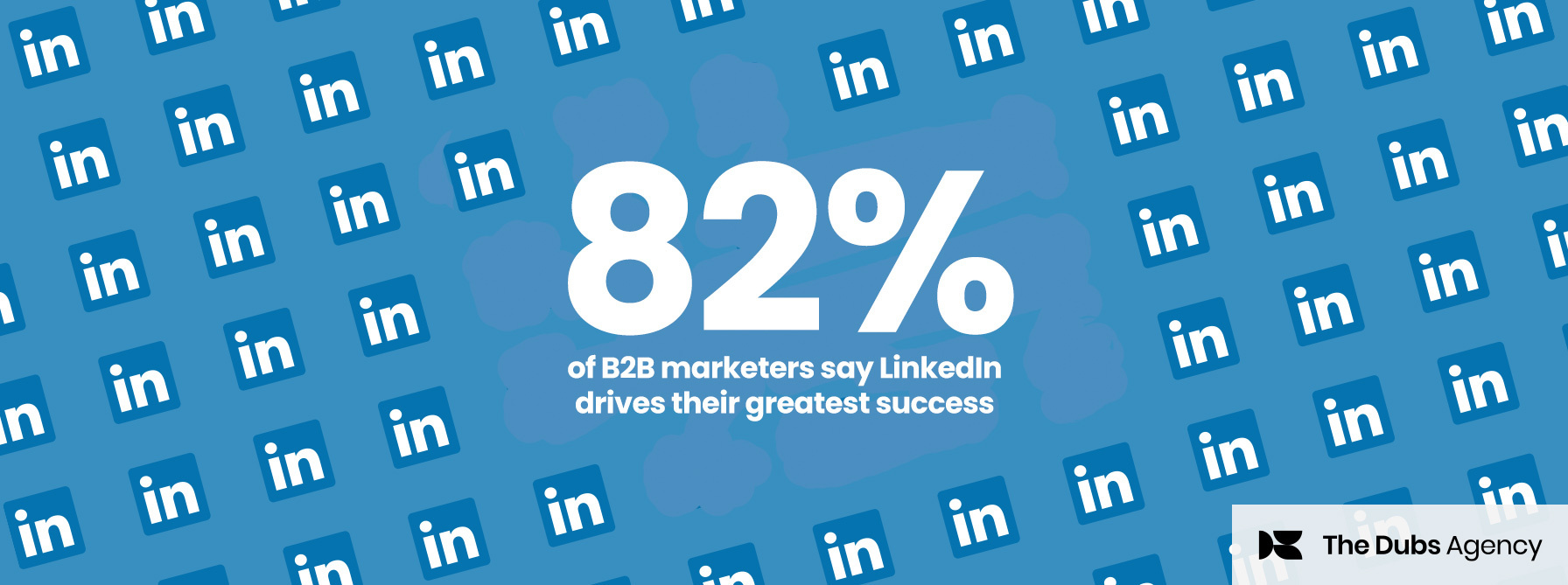

- B2B Marketers rank LinkedIn as the most powerful platform to influence B2B decision makers*

- 87% of Buyers prefer credible content from trusted industry influencers**

Given these figures, for any financial-services, fintech or broker-facing B2B brand (in Australia or globally), ignoring LinkedIn truly is not an option.

The ‘do’s’ of LinkedIn B2B marketing

Here are what I consider best-practice fundamentals;

1. Know your target profile

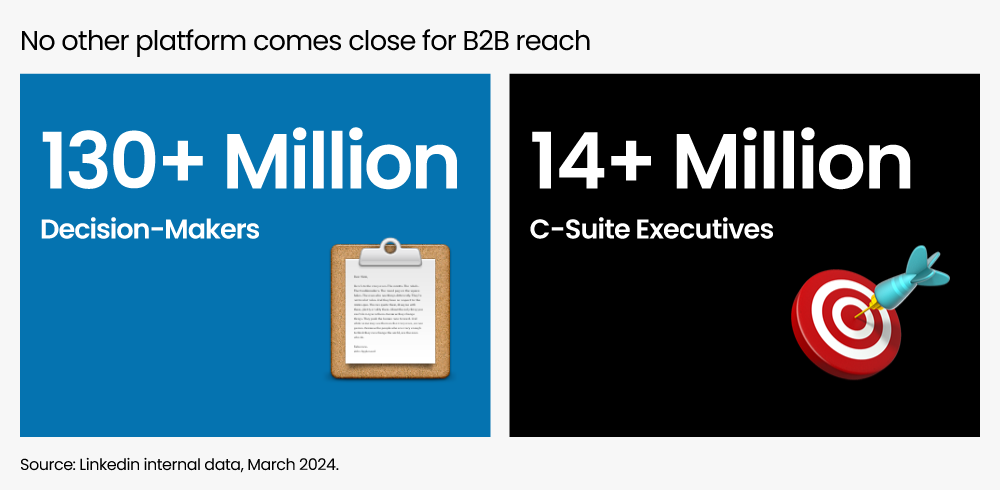

Use LinkedIn’s professional targeting to reach decision-makers by role, seniority, company size, industry. According to Forrester the average buying group now includes 13 stakeholders, and is up to 19 for large purchases. This means you don’t just need to know the persona of your main buyer but that of the whole buying committee.

2. Lead with value and insight

Don’t just push product. Share analysis, thought leadership, peer-case evidence. In the 2024 Edelman & LinkedIn “Thought Leadership Impact” report, high-quality thought leadership helps buyers rethink assumptions and increases willingness to pay for expertise. In other words, your content should elevate not just inform.

3. Mix organic and paid approaches

Organic content builds brand trust, paid campaigns drive scale and conversion. LinkedIn 2025 data shows posting on LinkedIn is up 41% in the past three years, video creation has jumped 27% in the past year and views have risen 36%. So schedule regular posts, engage comments, then amplify top-content with paid.

4. Measure what matters

Don’t get distracted by vanity metrics. Focus on lead quality, conversion rates, account engagement. The Content Marketing Institute reports conversions are the top metric for 73% of B2B content marketers. Ensure you have an attribution model aligned with your funnel.

5. Build the human connection

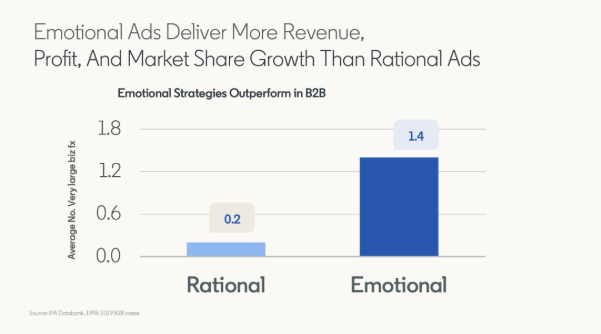

In a platform built around professionals, the human voice wins. Encourage your executives, advisers or brokers to publish posts, comment in their own voice, share experiences. It builds credibility, moreover, research from LinkedIn’s B2B Institute & System1 proved that emotional ads cut-through and resonate with both in-market and out-of-market buyers.

“ In the B2B jungle, it’s not about shouting louder, it’s about talking to the right person, at the right moment, with authenticity.”

The ‘don’ts’ of LinkedIn B2B marketing

Avoid these common pitfalls:

- Don’t forget about the whole buying committee. B2B decisions are not made in silo but in large groups of colleagues across professional practices. Make sure you consider and target everyone that will influence a buying decision.

- Don’t forget about Gen Z. Making up 71% of the buying committee with Millennials, this generation is key and engaging with them effectively is critical. LinkedIn’s platform research shows GenZ had 82% more video views and 64% more video engagements than the average LinkedIn user.

- Don’t skip video. Video creation on LinkedIn has jumped 27% YoY and video watch time is up 33%. Plus, 96% of marketers say that video increases user understanding of their product or service. Video is a critical component of your B2B strategy.

- Don’t ignore creative and format. Even in B2B, attention is earned. According to Marketing Week, 77% of B2B creative fails to register emotionally or create long-term impact. Invest in strong visuals, clear copy, differentiated positioning.

- Don’t skip alignment with sales. Marketing on LinkedIn works best when aligned with your sales motion. Leads generated who aren’t followed-up are wasted.

Special considerations for financial services brands

Given your focus on financial services marketing, bear these nuances in mind;

- Compliance-friendly tone: With regulation high (ASX, AFSL, ASIC, etc), your LinkedIn content needs clarity, transparency and correct disclaimers. Keep jargon moderated and audience friendly.

- Role of trust and credibility: Financial services buyers (brokers, SMEs, advisers) are risk-sensitive. Use LinkedIn content to build authority – case studies, advisor testimonials, thought pieces on regulatory change, not just product push.

- Audience segmentation: You might have multiple sub-audiences (brokers, advisers, SMEs, lenders). Use LinkedIn’s targeting capabilities to tailor messaging accordingly for example, separate campaigns focusing on “Broker alerts” vs “SME CEO insights”.

- Value of education-lead content: Given complexity (quant structures, compliance, digital lending), content like “how-to”, “what’s changing”, “future of…” works well to engage senior roles who use LinkedIn for professional reading.

- Visual story-telling: Use hero visuals aligned to your brand values (“Expertise – Back it up / Accessibility – Be there / Quality – Do it better”). On LinkedIn posts and carousel ads, consider branded templates consistent across your campaigns.

LinkedIn remains the single most powerful social platform for B2B marketing. Use it not as a broadcast megaphone, but as a strategic tool for engagement, influence and lead generation.

In my view:

“ If you create content that helps a broker close one more deal, or helps an SME owner borrow smarter, you’re not just doing marketing, you’re adding value. And the network responds accordingly.”

Stay strategic. Stay consistent. And remember, content on LinkedIn isn’t just consumed – it influences decisions.

If you liked this article and want to know more contact The Dubs Agency we’d love to help.

[Full disclosure: The views and opinions expressed in this publication are those of the author. They do not reflect the views or opinions of any organisation or entity.]