In financial marketing, technology earns its place only when it withstands pressure. Tools that behave unpredictably, rely on unclear licensing, or leave gaps in audit trails have no place in a regulated environment. Every output must survive compliance review, brand scrutiny, and client interpretation.

This is why the shift toward agentic AI warrants serious attention. Many discussions still center on scale, automation, or creative novelty. None of that matters if a system cannot operate with discipline. What matters instead is the emergence of structured, governable agentic architectures that extend production pipelines without compromising oversight. The NANDA research community offers a blueprint relevant to financial marketers today. NANDA (Networked Agents And Decentralized Architecture), with its roots in the MIT Media Lab, is quickly becoming the architecture and stack for an internet of agents. It’s federated model allows agents to exchange work across organizational boundaries while maintaining the governance controls regulated industries require.

“ Agentic networks are not emerging. They are actively standardizing and institutionalizing.”

This shift is already visible in how agentic systems are being deployed inside regulated organizations. What were once experimental, internally bounded workflows are now being formalized through shared interfaces, agent registries, verifiable identity, and controlled execution boundaries. These systems are designed to operate within existing governance frameworks rather than around them. The result is an operational layer that compliance teams can review, leadership can defend, and production teams can rely on under real-world pressure.

Contained pipelines are no longer enough

The first wave of AI adoption relied on controlled pipelines. These were self-contained systems executing narrowly defined tasks with predictable behavior. In regulated environments, this approach enforced licensing discipline and ensured every asset carried a defensible provenance chain.

But constraint cuts both ways. Closed systems integrate only manually wired tools. Every new capability requires bespoke development. Every spike in demand forces teams to purchase infrastructure rather than leverage external capacity. Bottlenecks are absorbed internally, regardless of whether the limitation is technical, operational, or organizational.

The next stage requires pipelines that remain governed but can participate in broader agentic networks. These systems authenticate themselves, exchange work across verified agents, distribute computation safely, and still deliver outputs that withstand compliance and regulatory review. This is not a move toward openness for its own sake. It is a move toward resilience and scale without loss of control.

From isolated workflows to networked intelligence

Project NANDA, developed at MIT, addresses four structural choke points that have historically limited enterprise AI adoption: naming, identity, trust, and orchestration verification. Grounded in prior work on AutoML, split learning, and privacy-preserving computation, NANDA provides foundational infrastructure for network-addressable agent ecosystems.

In practical terms, this allows agents to identify one another, verify capabilities, and coordinate tasks across organizational boundaries without exposing proprietary systems. For financial marketers, this marks a shift from isolated automation to governed participation in agentic networks that can be reasoned about, monitored, and constrained.

Why Agentic networks matter for regulated industries

Trust you can demonstrate.

In regulated environments, trust must be demonstrable rather than implied. Modern agentic systems are designed to produce clear, reviewable records of origin, licensing, and decision flow. Compliance discussions move away from subjective assurances and toward documented system behavior.

Collaboration without exposure.

Financial marketers have historically avoided collaboration on models or data because the risk outweighed the benefit. Advances in distributed learning and controlled execution now allow verified partners to contribute capability without sharing raw data or proprietary logic. Capability expands while risk remains bounded.

Parallel workflows without parallel headcount.

Traditional AI pipelines execute sequentially. Networked agentic systems enable multiple stages of work to operate concurrently across compatible agents. This event-driven, contract-based execution model allows firms to handle volume surges without linear increases in staffing or infrastructure.

A double garden wall for the Agentic era

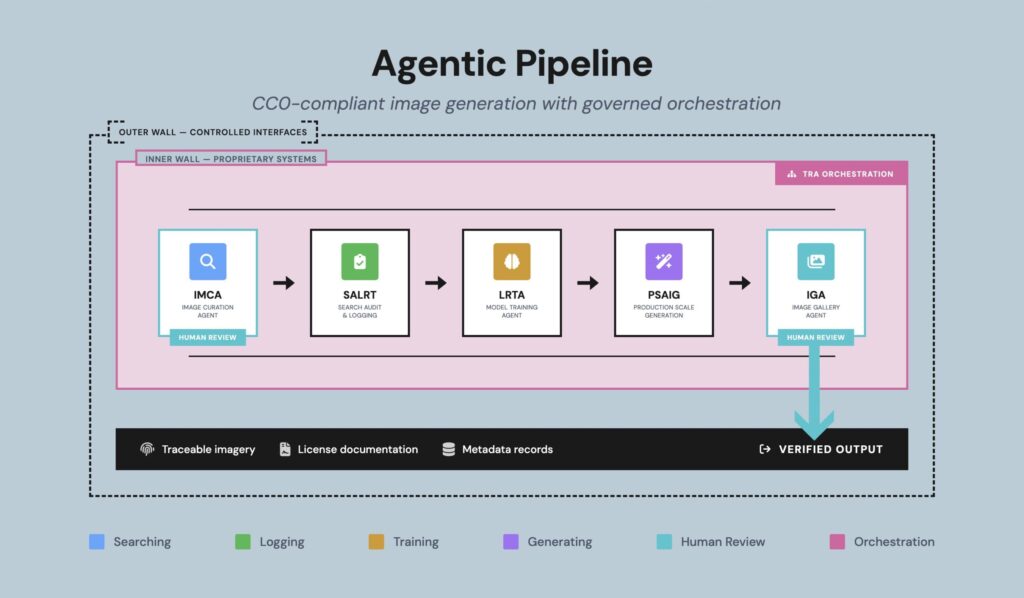

Regulated industries cannot afford to expose workflow elements that constitute competitive advantage or compliance-sensitive logic. The appropriate architectural response is a Double Garden Wall.

The inner wall protects proprietary datasets, screening logic, and brand-governance frameworks. These remain sealed and non-negotiable. The outer wall exposes only what external systems require: controlled capability interfaces, verifiable records, and traceable outputs. Built this way, systems gain interoperability without dilution, collaboration without intellectual property leakage, and scale without compromising compliance.

A live production case

The Dubs Agency illustrates this transition, operating a production-grade, CC0 (Creative Commons Zero)-compliant ‘No Rights Reserved’ image generation pipeline. The system employs specialized agents for sourcing, dataset preparation, fine tuning, generation, and workflow management. Governance is strict: public-domain inputs only, full chain-of-custody tracking, and aesthetic screening for accuracy and consistency.

Historically closed by design, integrating with agentic network infrastructure enables measurable advancements once agents are registered, verified, and policy bound. These include controlled collaboration through decentralized registries, zero trust interoperability where each agent governs its own exposure, distributed fine tuning across verified compute without revealing private datasets, elastic job distribution across compatible agents, and production-scale auditability where every autonomous step leaves a clear record.

What this means for financial marketers.

The value is straightforward. Stronger controls. Faster output. Broader capability without compromising compliance posture. This is the difference between AI as a novelty and AI as operational infrastructure.

Financial marketers should evaluate agentic systems using three uncompromising questions. Can the system scale without weakening oversight? Can every output withstand compliance, client, and regulator review? As the firm grows, does the technology reinforce discipline or fracture under pressure?

The industry does not need spectacle. It needs systems that behave predictably across volume spikes, regulatory cycles, and brand-governed workflows. When implemented with rigor, agentic AI is not about disruption. It is about operational reliability at a scale previously out of reach.

The firms that excel will not be those deploying the most colorful demonstrations. They will be the ones deploying systems that deliver controlled growth, verifiable governance, rapid execution, and credible audit trails. The shift toward networked agentic pipelines is already underway. The institutions that master it early will define the standard others are forced to follow.

If you liked this article and want to know more contact The Dubs Agency we’d love to help.

[Full disclosure: The views and opinions expressed in this publication are those of the author. They do not reflect the views or opinions of any organisation or entity.]