With TikTok’s immense rise in popularity – with over 1 billion users, 60% of them being Gen Z – it’s fast becoming the best platform to create lifelong relationships with young people. However, its confusing trends, from viral dances to people throwing objects in the air to see if it lands on their head, can be an intimidating platform for finance marketers to decipher. To help financial marketers make sense of what is at times baffling behaviours and trends, we’ve compiled a detailed cheat sheet to turn hesitant finance brands into TikTok masters.

Gen Z live on TikTok

TikTok has a simple premise – short-form videos that are only one to three minutes in length. Yet, it’s become one of the fastest growing apps in the world. With 1 billion active users, most of which are Gen Z, TikTok is a platform finance brands can utilise to connect with younger audiences.

TikTok provides a prime opportunity for finance brands to capture Gen Z’s attention daily, enabling them to build lifelong relationships with the brand. While TikTok users are predominantly Gen Z, that’s not the entire user base, with TikTok users in the US, UK and Aus ranging from 10 years old up to 49.

- 10-19 – 32.5%

- 20-29 – 29.5%

- 30-39 – 16.4%

- 40-49 – 13.9%

- 13-17 – 31.56%

- 18-24 – 36.34%

- 25-34 – 25.2%

- 35-44 – 5.21%

- 18-24 – 26%

- 25-34 – 9.3%

- 35-44 – 8%

With Gen Z becoming the largest generation, comprising almost 30% of the world’s population, and the largest user on TikTok, this offers an important opportunity for finance brands to connect with the people who will soon engage with the finance world in significant ways.

What users engage with on TikTok

When done in a calculated and targeted way, TikTok can reap large rewards for finance brands. It can increase brand awareness and build a large presence online, with TikTok seeing a much higher engagement rate of 17.96% compared to Instagram 3.86%.

Not only that but by creating a strong presence on TikTok it can help increase sales, with 49% of users purchasing a product after it was advertised, promoted or reviewed only once on the app. Here are four growing trends on TikTok finance brands should produce:

Educational content is what users want

“ 49% of users purchased a product after it was advertised, promoted or reviewed on TikTok.”

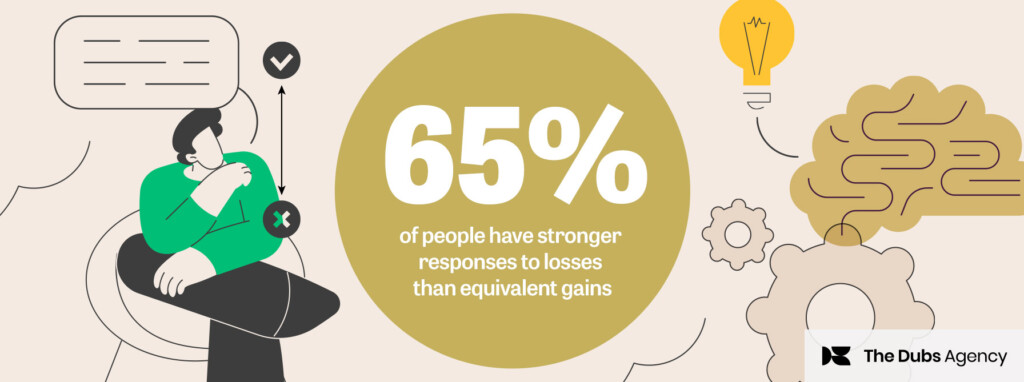

With a growing trend of financial misinformation on TikTok, this provides a perfect opportunity for finance brands to produce factual and educational content users want and need. Creating easy-to-understand content about topics Gen Z wants and needs is a great way to build trust, loyalty, and brand awareness. In fact, educational content made consumers 131% more likely to purchase finance products and services. By ensuring presenting a product or service as a solution to a specific problem Gen Z has, finance brands can achieve greater engagement and outcomes from their content and social program.

Here are three finance topics Gen Z engage with the most on TikTok:

- Investing and micro-investing

- Saving and how to reduce debt

- Wealth generation

Collaboration

Collaborating with financial influencers (fin-fluencers) or a regular influencer is an easy way for finance brands to build a following and gain greater exposure with their target audience. By joining forces with prominent figures on the platform, this builds consumer trust through social proof.

Finance brands have the option to collaborate with a range of different influencers. Here are the pros and cons of each:

- Micro-influencer: A micro-influencer doesn’t have the same reach and popularity as a larger influencer, however, they generally offer higher engagement rates and promote a stronger audience connection at a more reasonable price.

- Fin-fluencer: A financial influencer is a great option for finance brands as they are trusted and already have an audience engaged with financial topics. However, it’s important that finance brands align themselves with ones that offer accurate financial information.

- Mega-influencer: A mega-influencer is a great option as finance brands have access to a large audience and can generate large exposure. Often, mega-influencers don’t have the same audience connection so finance brands should ensure their collaboration is engaging through things such as giveaways and challenges.

The US challenger bank Step recently collaborated with TikTok mega-influencer Charli D’amelio to help launch their brand. Step is a bank targeted at teenagers, making their collaboration with TikTok’s number one influencer the perfect choice. This saw them offer a giveaway and referral scheme, captivating young audiences and promoting lead generation.

In Australia, Up Bank took a slightly different approach, partnering instead with fin-fluencer @tashinvests to promote their finance brand. This campaign produced over 1.5 million impressions and directly resulted in 76 installations of the app.

Understand the trends and challenges

TikTok is made up of trends and challenges that users create. Whether it’s a music trend or a gamified challenge, creating one that represents your finance brand is a great way to generate leads, exposure, and brand awareness.

The Ma French Bank successfully created and leveraged their own TikTok challenge to gain high engagement and lead generation. Targeted at teenagers, Ma French Bank launched their WeStart teen bank account using the hashtag #WeStartChallenge. They encouraged users to get creative with their gamified branded effect, to try and win a PlayStation 5. In total 100,000 people created videos and they generated over 300 million impressions.

Regularly checking TikTok’s trending hashtags, videos and effects will ensure finance brands can create relevant content as it happens.

Here are some current hashtag trends on TikTok that finance brands can take part in:

- #learnontiktok – like the hashtag suggests this is a trend where everyday people or businesses teach users something new.

- #randomthings – this hashtag is accompanied by users explaining ‘random things that make sense…’ Finance brands can utilise this trend to explain financial topics that may be confusing to younger audiences, but ‘just make sense’.

- #personalfinance – this hashtag is accompanied by users providing important information on personal financial topics such as saving, reducing debt and investing and has gained over 4.4 billion views.

Targeted in-feed ads

TikTok offers the opportunity for brands to create targeted ads that appear organically on users ‘For You’ page. This allows brands to gain exposure and brand awareness without having to build a large follower base and having to stay on top of trends.

Finance brands should look at creating ads that are authentic and utilise real people speaking to the camera in order to promote brand trust and loyalty. An Australian finance brand that has nailed TikTok’s in-feed ad feature is We Money. We Money utilised content creators speaking directly to the camera to promote their product and services. This saw them gain over 1.9 million impressions and generated a 5.87% conversion rate.

Things to consider before finance brands start dancing with joy

While TikTok provides a great opportunity for finance brands to gain greater exposure and build their online presence with young people, it doesn’t come without some risks. A recent exposé by the Australian publication ABC and the American publication Forbes has uncovered the dangers TikTok has for users in promoting unhealthy and negative information. This perception of TikTok as a negative platform for teenagers is growing slowly and should be a consideration for finance brands.

With financial misinformation surrounding investments leading to users making poor financial decisions, TikTok subsequently banned investment promotions on the app. While you are able to educate and teach users how to invest, you can no longer create branded content about it. This shouldn’t be seen as a negative but instead a positive for finance brands as it showcases that despite any hesitations towards TikTok, it’s introducing policies to benefit its users and in turn ensuring financial content can be viewed as more trustworthy and credible.

TikTok is the competitive edge for finance brands wanting to target Gen Z

There’s a large finance community and an even larger desire for financial content on TikTok, making it a great place for finance brands who want to target a younger demographic to be. Ultimately, finance brands wanting to leverage the power of TikTok should focus on producing educational content that provides accurate and helpful financial information Gen Z needs.