Being customer-centric – taking the time to understand your audience’s problems, offering relevant solutions and speaking their language – is at the foundation of financial marketing. And when it comes to another equally important audience – your CFO – the same thinking should apply.

In a conversation with LinkedIn’s Jon Lombardo for the Financial Marketer podcast, The Dubs MD, Josh Frith raised the significance of viewing content as an asset. It’s a concept that Lombardo wholeheartedly embraces, pointing us to a valuable white paper: Marketing to the CFO, co-produced by LinkedIn’s B2B Institute.

Based on research by marketing effectiveness researcher Fran Cassidy, the paper is described as “a 5-step playbook to more financially accountable marketing”. It urges marketers to partner with their finance peers and adopt, “shared objectives, language, and metrics tied to measured value creation.” Cassidy’s insights are essential reading for B2B financial marketers who want to be taken more seriously by the finance team.

Gain the trust and the ear of your CFO

In most B2B organisations the CFO is the steward of the money; they decide on the marketing budget and what constitutes value. It wasn’t always this way. In times gone by marketers controlled product pricing and placement; now more often than not, decisions about data, analytics, strategy, pricing and more, all sit in the CFO domain.

To gain trust with the C-suite and reclaim your seat at the table and your voice in the conversation, it’s essential you demonstrate relevance. In her paper, Cassidy encourages marketers to think more broadly about what they contribute as marketers, to take back a more strategic role.

Many non-marketing types in organisations don’t appreciate the contribution of brands to business growth and value. In a 2019 Financial Times and IPA study of senior business leaders, only 20% of non-marketers in the global sample believed that brands were very important to profitability, only 19% believed they were important to growth, and only 11% to future cash flow.

That’s why it’s so critical that marketers be able to show how building a brand strengthens a company’s financial position, increasing its pricing and power and generating future cash flow. Financial marketers need to articulate how marketing is a profit, not a cost centre.

“ Financial marketers need to articulate to their CFO how marketing is a profit, not a cost centre.”

Cassidy also emphasises the importance of reinforcing how B2B decisions are as much emotional as they are rational; and that value is driven by the combination of commercial discipline, a customer lens, creativity and imagination. And of course, it’s not enough to explain how you drive value – you need to be accountable for value creation in all aspects of your marketing, and adopt an evidence-based mindset.

Another important part of this changed approach is to think differently about how you use language and data.

Build business plans, not marketing plans

In Lombardo’s words, the better understood we can be, the more budget we’ll get – and that means we have to speak finance: “the language of business”. The Marketing to the CFO paper lists definitions for some key financial terms and encourages better financial literacy for marketers (something that shouldn’t be a stretch for B2B financial marketers).

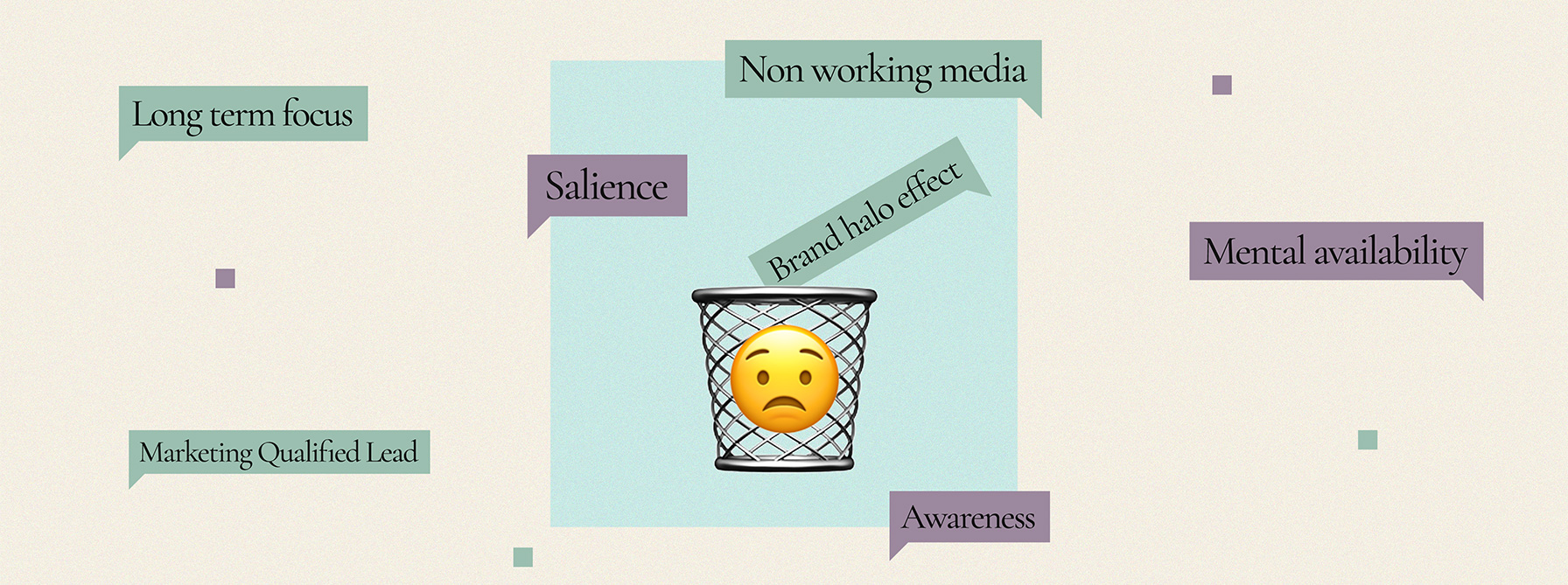

Consider this fun fact: only 2.6% of boards have a marketing-experienced board member. If you’re talking to your board or C-suite about budget using marketing buzzwords or vanity metrics, chances are you’re not being persuasive, inspiring trust – or perhaps you’re losing them completely.

To illustrate why we need to adapt our language, Cassidy highlights the term ‘non-working media’ – a buzzword used to describe budget for the production of content, as opposed to its distribution. When speaking about this example Lombardo says, “I work in advertising and marketing and I barely know it.”

Cassidy explains that when one organisation stopped using ‘non-working media’ and substituted with “asset creation”, it helped the marketing department in discussions about the budget line with finance.

“Asset creation is clear to the marketer,” Lombardo says. “It’s clear to the finance team, it’s clear to the sales team, it’s clear to the operations team that this is an asset that can be developed to be used over and over and over again.”

If you can start to think differently about the marketing-finance relationship, with everybody learning to understand each other better and speaking the same language, there are immense growth opportunities, Cassidy says. And it might even help your career.