To capture the attention of audiences beyond your organic social following is vital for finance brands looking to grow brand awareness and ultimately generate new leads. To reach the right audience in a way that effectively and efficiently drives engagements and leads requires careful planning and an understanding of your industry, brand and the nuances of your target audience – this is where media buying and planning comes in. Paid media buying and planning is effective in amplifying your social content enabling you to reach a targeted audience base and nurture them down the customer acquisition funnel. We sat down with The Dubs social media strategist, Tara Cimino, to understand the benefits of working with a financial services expert when executing a paid media strategy.

What is media buying and planning?

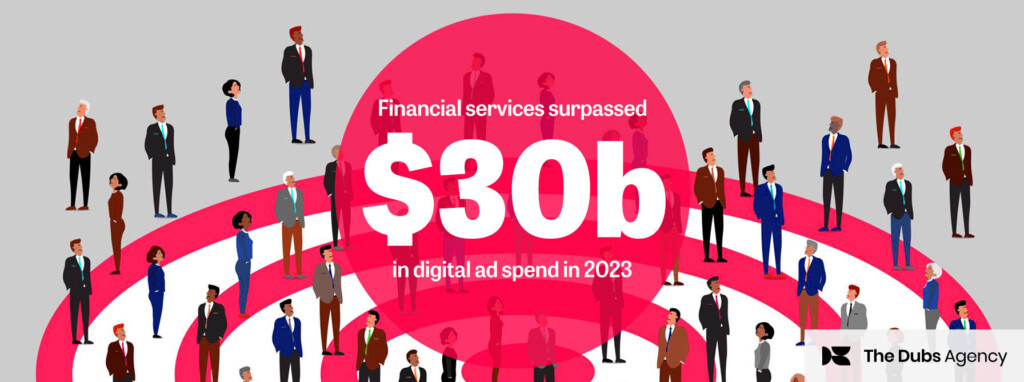

Media buying and planning have never been more important in today’s climate with the pandemic forcing brands to go digital. While previously many large traditional finance brands benefitted from being well-known and having multiple physical locations, the battle for clients is now being waged online. “In the current climate finance brands have been forced to go digital. The evolution to social media has been ramped up,” Cimino explains. “The big names that some brands would look to as the biggest competitors actually have the smallest digital footprint.”

While finance brands still need to commit to an always-on content strategy across their social media channels, media buying and planning can amplify their reach past their organic followers. Essentially, media buying is purchasing advertising space on social platforms that are targeted and tailored to a particular demographic. Just like you purchase ads for television, you can do the same on social platforms.

The benefits of paid media

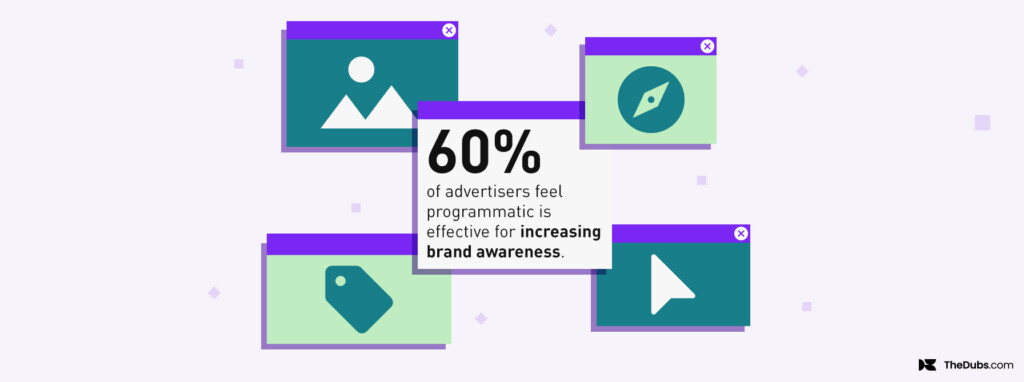

“All finance brands are now seeing the benefit of paid media as you can reach an audience beyond your organic following,” says Cimino. Media buying and planning is an important element of any finance brand’s content strategy as it enables them to reach an interested audience they would have failed to reach. When done correctly, a paid media strategy amplifies a brand helping to generate new leads, improve brand awareness and increase customer acquisition.

A media buying and planning strategy enables finance brands to target niche audiences. Rather than your finance brand’s content strategy simply being seen by your organic following, a paid media strategy can ensure your content is seen by exactly who you want. In fact, nearly 75% of successful content marketers say their content is meant for a specific audience.

Cimino explains, “On social media, you can target a user’s specific job title, so you can be so narrow with who you want to get your content in front of rather than just broad brushstrokes.”

“ All finance brands are now seeing the benefit of paid media as you can reach an audience beyond your organic following. ”

“Publishing a consistent frequency of content through an amplification program not only increases brand awareness, brand trust and directs increased traffic to websites, but that trust is evident through an increase in following,” notes Cimino.

Our work with Aberdeen (across 6 years) saw them go from 0 followers on X to 190,000, 10,000 followers on LinkedIn to 110,000, and 5,000 followers on Facebook to 25,000. The same goes for AllianceBernstein. Within two years of working with The Dubs, they increased their X followers from 4,001 to 20,000 and LinkedIn followers from 47,000 to 71,000.

Why finance brands need to employ the experts

“The key in working with financial services experts is understanding the audiences that our clients want to reach,” states Cimino.

Cimino continues, “We ensure targeting is specific for each campaign, be that institutional investors or IFAs, to retirement advice or insurance. There are so many different audiences within the financial services sector to reach, and as experts, we have the understanding, experience and historical data to be able to reach a wide variety of audiences effectively.”

A financial expert can offer the competitive edge your finance brand may be looking for by having a deep understanding of who you want to reach. Without knowing how to target your audience, your paid content strategy will often be ineffective.

The roles and services of a financial services expert

Beyond understanding audiences and how to execute a paid media strategy, a financial services expert supports finance brands throughout the entire process. “We support our clients beyond social amplification – social is the end product,” explains Cimino. “We help provide the strategy behind the content they’re creating from website optimisation to creatives, to ensure audiences follow the user journey through to completion.”

The role of a media buying and planning agency includes:

- Identifying an objective: Prior to creating a paid media strategy, it’s critical your finance brand identifies a key outcome, whether that’s to increase web traffic or sign people up to a webinar. This is important to set out clear KPIs and will impact the content you create, the channels you market on and the amount of money it will cost.

- Strategy: This is the main area in which a financial services expert will help your brand. A clear strategy that works to achieve your objective is paramount to a successful paid media content strategy. Understanding your audience’s needs and objectives is key to ensuring your strategy is effective.

- Website optimisation: A strategy is only effective if your website is optimised to achieve your objective. Ensuring it’s user-friendly and accessible prior to implementing your paid media strategy will ensure greater success. As Cimino notes, “If we’re sending traffic to a website you need to consider what action the user will take. We need to monitor them and if they’re not doing what the client wants we help optimise the website so the user does what we need them to do.”

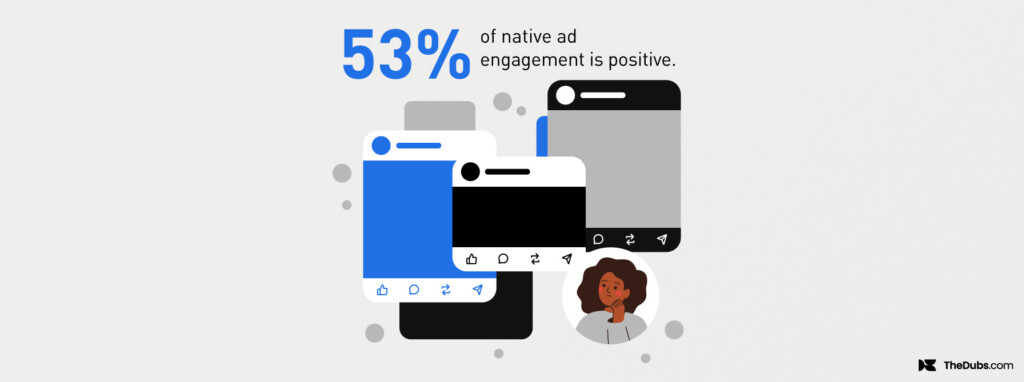

- Content:Creating engaging content, tailored to your audience, that funnels audiences to your website will ensure greater lead generation and client acquisition. Your content needs to be able to capture the attention of your specific audience. Cimino says, “you need to consider what’s going to make a user stop in their social media feed, engage with your ad and then click through”.

A financial services expert has a detailed understanding of how to track and attribute media spend and engagement to customer acquisition and FUM. Their historical data, clear understanding of niche audiences and experience means your finance brand won’t be pumping money into a media buying and planning strategy that’s ineffective.

“When attributing media spend and engagement to client acquisition it’s really important to go beyond vanity metrics,” explains Cimino. “As experts in the field, we see it as important to focus on website analytics. We not only understand the data but also help our clients set up their objectives so we can understand the user journey through to completion.”

Media buying and planning is critical for finance brands

At the end of the day, media buying and planning is an important component of your finance brands’ content marketing strategy as it enables you to reach beyond your organic following. A targeted approach to paid media means you can craft tailored content that is seen by specific, niche audiences. This can help generate leads, increase client acquisition, and improve brand awareness and trust. Working with a financial services expert can improve your media buying and planning strategy as their understanding of your brand, industry and audience can ensure it’s effective and based on prior learnings. An effective paid media strategy can offer a competitive edge if your finance brand is looking to maximise its social media content.