In financial services, every word you publish is a liability – until proven otherwise. Brand isn’t built by storytelling. It’s built by surviving scrutiny. Your message is only as strong as your last audit, your last filing, your last client call. So when you bring AI into the mix, don’t chase transformation. Demand utility.

Forget flashy demos. Forget buzzwords. Innovation in this industry means doing boring things brilliantly – again and again, without fail, without hallucination, without dragging compliance into a fire drill.

AI that works in finance does four things. Nothing more. Nothing less.

1. Automates the repetitive, obeys the rules

If the tool can’t format a fact sheet, update a quarterly stat, or check a disclosure without freelancing, it doesn’t belong here. Period. Financial content is not creative writing. It’s executable code – one bad output and you’re radioactive.

2. Reduces friction, not just headcount

If your team needs to spend a quarter learning the new “AI platform,” you’ve added overhead, not capability. The right system vanishes into the workflow. It doesn’t announce itself. It doesn’t ask for a parade. It gets the damn brochure out the door.

3. Produces outputs you can defend in front of legal

If you can’t trace where a line came from – what data informed it, who approved it, when it changed – it doesn’t matter how fast it was generated. You just added a risk multiplier to your process. In this industry, “explainability” isn’t nice to have. It’s table stakes.

4. Understands context—or gets shut down

Financial content isn’t general-purpose. It’s contextual, regulated, and often jurisdiction-specific. If your AI doesn’t know the difference between yield and return, or between “view” and “recommendation,” it’s not just inaccurate – it’s noncompliant.

Behind-the-scenes tech, frontline impact

The best AI in financial marketing isn’t visible. It doesn’t pitch ideas. It handles the plumbing:

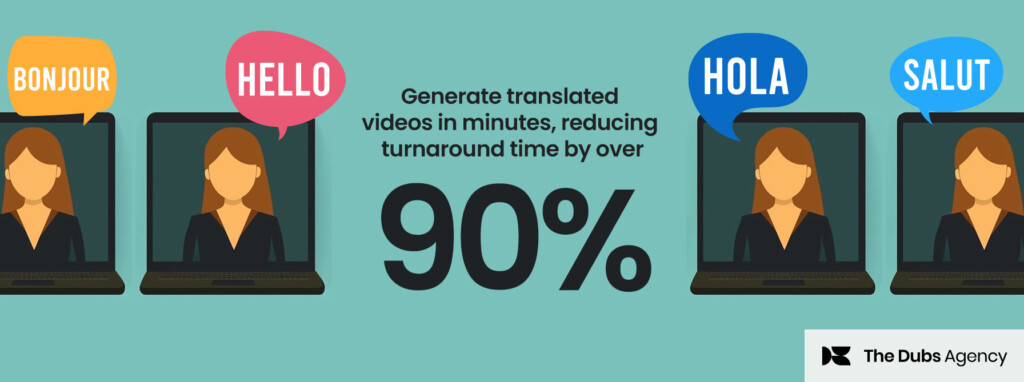

- Operational Capacity Planning: Whether it’s quarter-end or a campaign launch, AI helps route work where there’s bandwidth, predicting spikes, reallocating resources, and keeping SLAs intact.

- Client Sentiment and Relationship Insights: You don’t need a focus group. AI can parse emails, calls, and surveys to surface what clients are actually feeling, so relationship teams stay ahead of churn instead of cleaning up after it.

- Data-to-Content Engines: Performance data can feed directly into pre-approved templates, reducing delays and human error.

- Advisor-Facing Tools: AI-driven knowledge systems can surface only approved language and disclosures for use in advisor presentations and client emails.

How you vet AI in this space

You’re not just buying a tool; you’re buying liability. So ask the only questions that matter: Can it cut time-to-market without cutting corners? Can it meet compliance standards without triggering ten rounds of human cleanup? Can every line it generates be explained to regulators, clients, and your own risk team? Does it reinforce brand integrity, or does it bleed it out, line by line? And when your business doubles in size, does the system scale, or does it snap? If the answer to any of these is no, then what you’re looking at isn’t a solution. It’s a side project in disguise.

Final word: Innovation isn’t the show. It’s the system.

AI in financial marketing isn’t a strategy. It’s a supply chain. And it needs to be as reliable, regulated, and boring as a payroll run. If it’s working right, no one should be talking about it; they should be moving faster, with fewer errors and less drama.

The firms that win this next round won’t be the ones shouting “AI” the loudest. They’ll be the ones whose AI keeps their engine running clean, quietly, consistently, and without ever missing a beat.

If you enjoyed this article and would like to know more contact The Dubs Agency we’d love to help.

[**Full disclosure: The views and opinion expressed in this publication are those of the author. They do not reflect the views or opinions of any organisation or entity.]