As we approach 2026, the financial marketing landscape is poised for dramatic transformation. The Dubs Agency reveals six key trends that will reshape how financial brands connect with professional audiences, from the rise of Meta as a B2B powerhouse to the ethical deployment of AI-generated content.

Meta emerges as a serious B2B player

For years, LinkedIn has dominated the conversation around professional audience targeting. But 2026 will mark a turning point as Meta platforms establish themselves as credible alternatives for reaching institutional investors and financial decision-makers.

The data tells a compelling story. According to Brunswick Group’s Digital Investor Survey, 75% of professionals now use secondary social media platforms alongside LinkedIn. These sophisticated investors aren’t limiting themselves to a single channel, they’re consuming content across multiple touch points throughout their research and evaluation process.

Meta’s targeting capabilities have evolved to match this opportunity. Financial marketers can now reach users by job title, target competitors’ audiences, upload matched audience lists, and track conversions with precision that rivals LinkedIn’s offering. Early adopters are already seeing the results, with The Dubs Agency reporting highly cost-effective on-site conversions from professional audiences reached through Meta platforms.

The implication for 2026 is clear: successful financial marketers will need to develop sophisticated multi-platform strategies rather than putting all their eggs in the LinkedIn basket.

Video dominates the content mix

If 2025 was the year video became important, 2026 will be the year it becomes indispensable. Video uploads on LinkedIn have surged 45% year-on-year, and the platform projects an additional 65% growth by 2025, setting the stage for video-first strategies in the year ahead.

This shift reflects changing consumption patterns among financial professionals who increasingly prefer dynamic, visual content over static text. Financial marketers who have been slow to embrace video production will find themselves at a significant competitive disadvantage.

The key will be developing scalable video content strategies that balance production quality with volume. Financial brands should expect to produce regular video content across educational pieces, thought leadership interviews, product explainers, and market commentary to maintain visibility in increasingly video-saturated feeds.

Connected TV reaches critical mass

Connected TV advertising has crossed the threshold from experimental channel to mainstream media buy. CTV refers to television content streamed over the internet through smart TVs, devices like Roku and Apple TV, or streaming services like Hulu and YouTube, rather than traditional cable or broadcast signals.

The contrast with traditional linear TV buying is stark. Legacy television means purchasing dayparts and hoping your target audience is watching, with minimal targeting precision and limited measurement. You’re paying for broad reach during commercial breaks that viewers routinely ignore or skip.

CTV transforms this equation entirely. Financial marketers can now target households based on demographics, job titles, and viewing behaviour – reaching CFOs, wealth advisors, or institutional investors with precision impossible in traditional TV. Ads appear within streaming content in non-skippable formats, and detailed attribution shows which households viewed and what actions they took afterward.

The numbers reflect this shift, eMarketer reports in 2025, CTV ad spend in the United States is projected to reach US$33.3 billion, representing nearly 10% of total digital advertising expenditure. Statistic data shows these ads deliver a 95% completion rate, dramatically outperforming traditional video advertising. Most tellingly, 98% of LinkedIn users now watch connected TV, substantially higher than the 83% who watch linear television.

Professional audiences have migrated to streaming platforms, yet many financial brands continue allocating significant budgets to traditional TV based on legacy buying patterns. The question for 2026 is no longer whether to invest in CTV, but how quickly you can shift budget from outdated linear approaches that are delivering diminishing returns.

Immersive storytelling transforms long-form content

The traditional PDF report is facing extinction. In its place, financial marketers are embracing immersive, interactive digital experiences that drive dramatically higher engagement.

Nuveen’s Equilibrium Institutional Investor report exemplifies this evolution. Built using no-code responsive page development tools, the report features interactive infographics, dynamic charting, and multi-chapter navigation that guides readers through complex investment themes. The content is available in multiple languages including English, German, and Japanese, extending its reach across global markets. And won a Gramercy Financial Content Award, Gramercy Asset Management Content Marketing Award and was shortlisted for the Financial Services Forum Marketing Effectiveness Awards.

As Flourish reports, the results speak for themselves interactive reports generate 73% more read time compared to traditional PDFs. For financial marketers struggling to capture attention for lengthy thought leadership pieces, this format provides a path to making substantial content feel approachable and engaging.

In 2026, expect to see interactive annual reports, market outlook pieces, investment strategy guides, and ESG reports that leverage these tools to transform static content into immersive experiences.

AI-Powered podcasts scale audio content

Audio content has long promised efficiency for time-pressed financial professionals, but production barriers have limited its adoption. AI-powered podcast creation tools are removing these obstacles, enabling financial marketers to atomise written editorial content into conversational audio formats at scale.

These platforms can transform blog posts, research reports, and articles into natural-sounding podcast conversations. They offer the ability to incorporate recorded stakeholder voices, adjust scripts for compliance approval, and publish directly to platforms like Spotify.

The Financial Marketer podcast demonstrates this capability in practice, showing how AI can elevate editorial content without requiring extensive audio production resources. For financial brands with substantial written content libraries, this technology offers an efficient path to reaching audiences who prefer audio consumption.

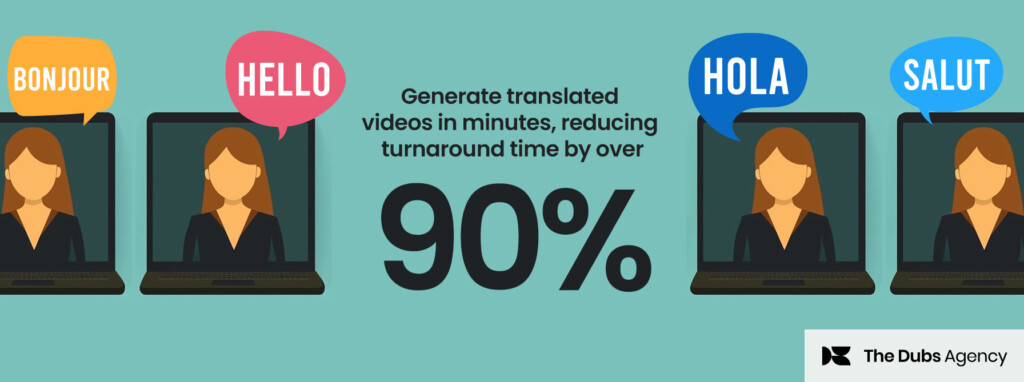

Multilingual video becomes accessible

Global financial brands have long struggled with the cost and complexity of producing video content for multiple regional markets. AI avatar technology is dramatically reducing these barriers, making multilingual video strategies accessible to organisations of all sizes.

These tools can take existing video content and rapidly generate versions with AI avatars speaking in different languages while maintaining consistent messaging and visual quality. The technology has matured to the point where the output appears natural and professional, suitable for external communications rather than just internal use.

For financial marketers operating across multiple geographies, this capability enables truly localised video strategies without multiplying production budgets. Expect to see increased use of this technology for everything from CEO communications to product explainers to educational content throughout 2026.

Josh Frith, Founder The Dubs Agency – AI Avatar speaking in Spanish and Mandarin.

Preparing for 2026

These six trends collectively point toward a financial marketing landscape that is more visual, more automated, and more distributed across channels than ever before. Success in 2026 will require financial marketers to embrace new platforms, invest in video capabilities, experiment with AI tools, and develop truly multi-channel strategies that meet professional audiences wherever they consume content.

The organisations that thrive will be those that view these changes not as threats to traditional approaches but as opportunities to achieve greater reach, engagement, and impact with the audiences that matter most to their business.

If you enjoyed this article and would like to know more contact The Dubs Agency we’d love to help.

[For full disclosure: The author used Claude to research this article while the podcast was created using ElevenLabs]