It’s no secret that a quality user experience (UX) plays a significant role in generating leads and building positive interactions between finance brands and clients. The valuation of UX through ROI can be useful as a quantitative measure of success, helping to attract buy-ins for enhancements, or to justify choices to management and clients. However, a recent trend of decreasing UX ROI suggests that having a quality user experience has become the norm, and is no longer a strong source of competitive advantage.

Return on investment of user experience

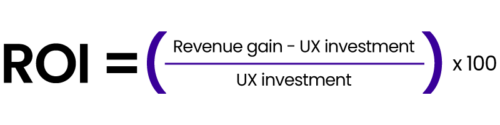

Calculating the ROI of your finance brand’s UX involves calculating the revenue generated by UX enhancements, and comparing it with the cost of producing these enhancements. It’s a monetary valuation of the effectiveness of elevating UX, and is a powerful tool when performing cost-benefit analysis. A finance brand’s user experience (UX) covers every interaction a customer has with its digital presence – from website usability to how intuitive a platform or app feels. It includes the clarity of content, ease of navigation, checkout or sign-up flows, customer support accessibility, and overall consistency across touchpoints. Good UX ensures that every step of the customer journey is smooth, effective, and aligned with the brand’s promise.

Understanding the ROI of the UX across your brand’s website and channels is beneficial to highlight how innovation and risk-taking in upgrading user experience can translate to profits, which can appeal to investors, management, and potential clients.It can be a simple way for marketers to evaluate the planned vs. actual results of their marketing strategy and continue a cycle of continuous quality improvement in regards to UX.

UX standardisation and implications

Gone are the days when having quality UX design offered finance brands significant differentiation from competitors. A standardised approach to good UX practices means users now expect quality interactions with finance brands, meaning brands which have effective UX systems are just meeting customer expectations rather than what was once considered exceeding them.

This standardisation has a number of implications, the largest of them being a decline in UX ROI, though this decline can also be partly attributed to saturation in the UX design field. While there haven’t been alternative results to an investigation by Forrester in 2019 suggesting that every dollar invested in UX design yielded a $100 return, many believe this to be outdated and not in keeping with the rapid developments of the digital world, including the sudden boom in AI development.

Jakob Nielson of UX Tigers explains that the decline in UX ROI “doesn’t mean UX research lacks value; it simply means the value is lower than before.”, before emphasising that UX efforts shouldn’t be forgotten or left stagnant, as

“ other companies are still improving their design and thus raising the bar that must be met to retain potential customers. ”

“ other companies are still improving their design and thus raising the bar that must be met to retain potential customers. ”

Ultimately, finance brands should aim for high-quality UX as a strategy to increase financial gain. Good user interface and UX systems can assist in instilling confidence in a brand’s ability to professionally and expertly manage finances, whether that be in banking where customers want to feel their assets are safe, insurance companies where straightforward navigation can reduce bounce rate, or asset management where effective design can convey expertise and trustworthiness.

The impact of AI on UX

With the recent boom in AI development, brands can expect changes in the UX design and processes. Its ability to enhance user personalisation and design for a fraction of the cost means brands that are able to use AI to improve their UX overall will have the opportunity to be leaders in cost and innovation.

The increasing accessibility of AI-driven personalisation – where AI algorithms are able to collect, process, and analyse user data rapidly to customise user experience – has revolutionised a brand’s ability to engage and convert users.

For example, Personetics is a cognitive banking company that leverages financial data intelligence and predictive data analysis to help banks and other financial institutions tailor their financial services to the individual level, demonstrating how AI-driven personalisation of UX can increase user engagement by up to 30%.

Though AI has the potential to revolutionise the UX design field and increase UX ROI, as AI technologies become more widespread and common across businesses, it’s likely to then once again become a matured and saturated practice.

In a nutshell

UX ROI calculations are a worthwhile resource for financial marketers as a simple and effective communication of cost-benefit evaluations of UX enhancements. Though it’s seen a decline in recent years, AI has the potential to create a spike in UX ROI (though likely only briefly) before practices return to a matured state and ROI declines again. Finance brands who harness AI to customise the UX of their digital experiences have the opportunity to be industry leaders and optimise conversions and revenue, driving positive brand sentiment and the conversion of new clients.

If you’d like to know more contact The Dubs Agency we’d love to help.