Traditional marketing approaches often fall short of capturing the nuanced decision-making processes of consumers. Enter behavioural economics — a field that integrates insights from psychology with economic theory to better understand how people behave in financial contexts instead of how they should behave according to classical economic models.

By leveraging principles like loss aversion, framing effects, and social proof, you can design campaigns that resonate more deeply with investors, driving better engagement and ultimately, more successful outcomes.

Global financial advertising platform Dianomi’s APAC managing director, Julian Peterson, said while behavioural economics can significantly help marketing he warned there are too “too many cases” of campaign effects being overstated.

“Humans can find it hard to overcome our inherent biases, therefore, ads that exploit these can be strong behavioural drivers. Behavioural techniques, such as choice architecture, can also be used for landing page and website design.” Peterson said.

“However, context is important and effects are not always as expected – constant testing and learning will help evaluate the effectiveness of targeting biases with an advertising campaign.” he said.

For those working in financial advertising Peterson suggested the “Save More Tomorrow” program to learn about behavioural economics. At the time of writing more than 15 million Americans are using the Save More Tomorrow approach to save towards their retirement.

This program was developed by behavioural economics pioneers Shlomo Benartzi and Richard Thaler with three core principles.

People are first asked to commit now to saving more in the future which helps avoid their “present bias”. Secondly savings rates increases are linked to pay rises to minimizes the influence of loss aversion since “take-home pay” does not fall. Thirdly, once people are signed up they remain in the program unless they opt-out. This makes use of inertia.

“ Humans can find it hard to overcome our inherent biases, therefore, ads that exploit these can be strong behavioural drivers.”

The power of loss aversion in financial marketing

One of the most potent concepts in behavioural economics is loss aversion, the idea that people fear losses more than they value equivalent gains. In financial marketing, this principle can be harnessed to shift consumer behaviour in subtle but powerful ways.

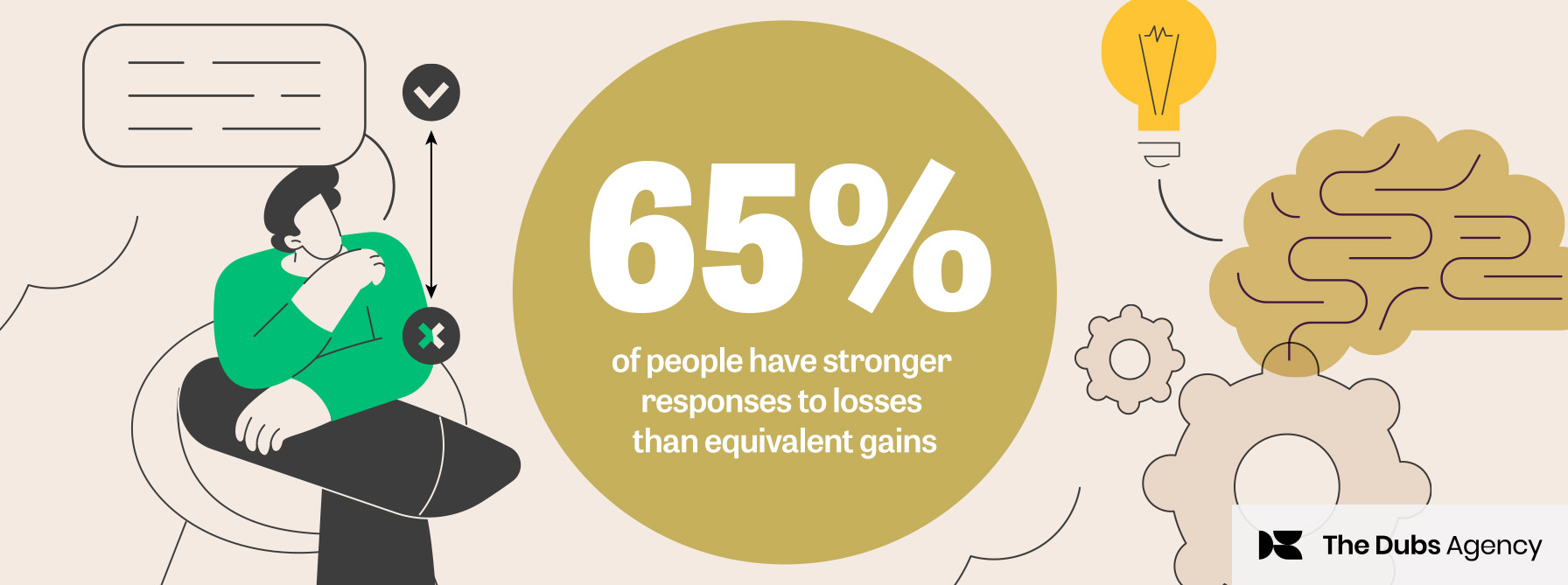

Research has shown people are significantly more likely to act when faced with the possibility of losing something they already have, rather than the prospect of gaining something new. A case study by Morningstar found 65% of people displayed signs of having stronger responses to losses than equivalent gains (loss aversion).

Financial marketers can apply this by crafting messages that frame inaction as a loss. For instance, “You could miss out on a comfortable retirement by not starting your investment plan today” could be more compelling than simply stating, “Start your investment plan today for a better future.” By strategically framing messages in the context of loss, marketers can tap into deep-seated psychological biases, encouraging consumers to take immediate action.

Framing effects and decision contexts

The concept of framing effects is closely related to loss aversion, where the way information is presented significantly impacts decision-making. Ultimately, understanding and applying framing effects can be a game-changer in your campaign design.

A notable example of this is the framing of fee structures in investment products. Research by Barberis demonstrates consumers are more likely to choose products when fees are presented as a small percentage of their investment rather than as an absolute monetary amount. This subtle shift in framing can make fees appear less daunting, leading to higher conversion rates.

Moreover, framing can be used to influence perceptions of value. For example, consider two investment products: one with a guaranteed return of 3% and another with a potential return of 7% but with higher risk.

By framing the guaranteed return as a way to “protect your capital in uncertain times,” marketers can appeal to risk-averse individuals while framing the higher-risk option as “a chance to significantly grow your wealth” might attract those more comfortable with taking on risk.

To effectively utilise framing effects, financial marketers need to understand the target audience’s risk tolerance and tailor messages accordingly. Testing different frames through A/B testing can also provide insights into which messages resonate most effectively with different segments of the market.

Social proof as a catalyst for action

Social proof, the idea that people look to the behaviour of others to guide their actions, is another powerful tool in the behavioural economics toolkit. In financial marketing, leveraging social proof can help overcome inertia and spur action, particularly in markets where trust and credibility are paramount.

One successful case study comes from Wealthsimple, a robo-advisor platform that improved user engagement by showcasing testimonials and user statistics prominently on its website. One way was by highlighting “over 100,000 investors have chosen Wealthsimple,” the platform effectively leveraged social proof to build trust and encourage new users to sign up.

Social media platforms provide fertile ground for amplifying social proof through user-generated content, where satisfied customers share their positive experiences, further validating the financial products or services being marketed.

“ 65% of people have stronger responses to losses than equivalent gains.”

Behavioural economics for marketers

To effectively incorporate behavioural economics into financial marketing campaigns, consider the following strategies:

- Segment and personalise: Behavioural economics principles are not one-size-fits-all. Segment your audience based on risk tolerance, investment goals, and other relevant factors, and personalise campaigns to align with these characteristics.

- A/B testing: Continuously experiment with different imagery, loss aversion messages, and social proof techniques to determine what resonates best with your audience. Use data-driven insights to refine your campaigns.

- Storytelling: Weave behavioural insights into compelling narratives.

- Transparent and simple messaging: While behavioural economics can make campaigns more sophisticated, clarity is still paramount. Ensure messages, regardless of how they are framed, remain clear, transparent, and easy to understand.

Behavioural economics: your secret to success

Harnessing the principles of behavioural economics allows your finance brand to move beyond traditional strategies and engage consumers on a deeper psychological level.

As the financial landscape becomes increasingly competitive, financial marketers who integrate these advanced behavioural insights into their marketing efforts will be well-positioned to stand out and succeed.